Currency Market

The International Currency Market, or FOREX, is an over-the-counter market where banks, central banks, sharks, investment management firms, hedge funds, and brokers buy and sell currencies. In general, the key drivers of FOREX are Central Bank Interest Rates, Central Bank Intervention, Options, Fear and Greed, and News.

Technical analysis in the Currency Market

Technical analysis is widely used among traders and financial professionals operating in the currency market. In the 1960s and 1970s, it was widely dismissed by academics; however, in a recent review, Irwin and Park reported that 56 of 95 modern studies found it produces positive results, but noted that many of the positive results were rendered dubious by issues such as data snooping. Academics such as Eugene Fama say the evidence for technical analysis is sparse and is inconsistent with the weak form of the efficient-market hypothesis. However, technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, “Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0.50 percent”.

The Determinants of Currency Fluctuations

In general, it does not exist a single theory explaining why and how currencies change. However, the traditional balance of payments model can be augmented considering various factors influencing the market.

The Balance of Payments is broken down into three important sub-components which sum-up to zero:

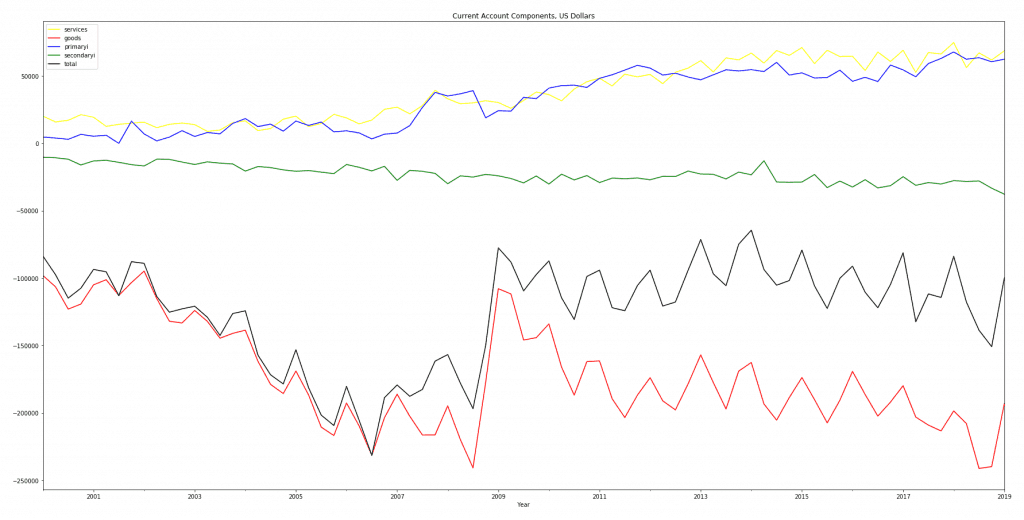

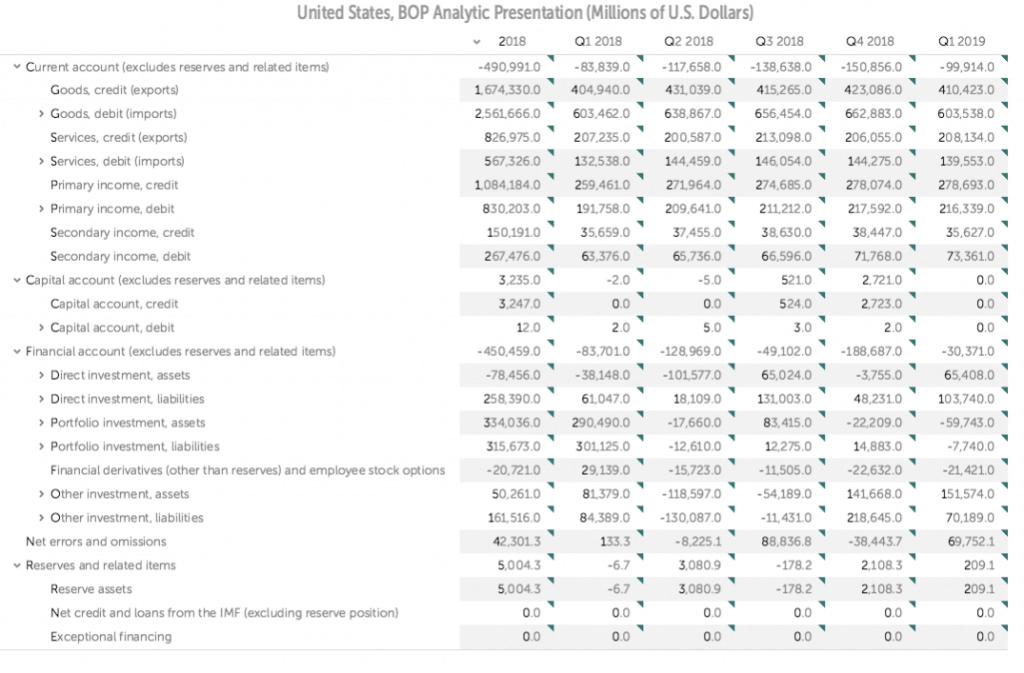

- the current account balance consists of the goods balance, the service balance, net income receipts, and net international transfers. The sum of the goods balance and service balance is called the trade balance; such a measure provides a quick look at the international competitiveness of the country. Specifically, the trade balance is calculated by subtracting all imports of goods and services (M) from the exports of goods and services (X). If a country’s imports exceed its exports (X-M<0) it is said to be running a trade deficit. In general, most developed nations exhibit a surplus in the services balance.

- the capital account balance keeps track of all the flow of non-produced and non-financial assets, such as the transfer of ownership in natural resources, intellectual property rights, franchises and leases, capital transfers of migrants, and debt forgiveness.

- the financial account balance tracks financial flows coming in and going out of the economy. Foreign direct investment consisting of long-term financial investment abroad, characterized by large ownership stakes (over 10 percent) in foreign firms. Portfolio investment composed of more liquid financial investments, generally undertaken in the form of stocks, bonds, and bank balances. Note that financial investment in the US increases as the interest rate rises, whereas capital investment decreases as the interest rate rises since the cost of amortizing the loan to purchase the asset increases.

Finally, the official reserve transactions tracks the international currency dealings of a country’s central bank. The central bank interacts not only with the domestic bond and money markets, but also with international currency markets, with foreign central banks, and with international institutions like the International Monetary Fund, and the World Bank. Indeed, as part of its task of conducting monetary policy at the national level, the central bank may hold a diversified international portfolio that includes international currency reserves and foreign government bonds. However, the central bank does not issue government debt, such as US treasury bills which are issued by the treasury department and recorded under government assets, in the category called other than official reserve assets.

The balance of payments theory states that exchange rates should be at their equilibrium level, which is the rate that produces a stable current account balance. Capital flows and trade flows quantify the amount of demand for a currency over a given period of time. If the trade flow balance is negative, the country imports exceed exports and vice-versa. The capital flow balance is positive if foreign inflows of physical or capital investments exceed outflows and vice-versa. Note that when the equity market is rising, the flow of capital increases determining a correlation to the exchange rate movement; the same is true for the fixed-income market in times of global uncertainty.

Other determinants of the exchange rate include:

- The money supply, expected future money supply, and the growth rate of the money supply. Countries experiencing a stable monetary policy see their currencies appreciating and vice-versa.

- Higher interest rates result in appreciation and vice-versa because of more attractive investments.

- The flow of funds into the financial assets of a country increases the demand for that country’s currency (and vice-versa).

- Economic data releases have a varying impact accordingly to the economic factors relevant at the announcement date. In general employment, monetary policy decisions, and inflation data remain the most market-moving releases.

- Quantitative easing has a strong impact. For instance, each FED round triggered a sharp rise in EURUSD.

Plotting BoP data with Python

US BoP data is available from a number of sources. However, among the others, the most reliable and easy to manipulate is IMF.

The Exchange Rate

Whenever the BoP registers a purchase of a foreign asset or a sale of a domestic commodity abroad, this implicitly indicates that there is a change in the demand for or in the supply of the foreign currency. Any change in the BoP sets off by definition a change in the market for foreign currency. For instance, the nominal exchange rate is simply the number of dollars you have to pay to get one British pound; the real exchange rate accounts for inflation in both countries. To obtain the real exchange rate we first divide the number of dollars we have to pay by the US price level and the number of British pounds we receive (£1) by the UK price level. The real exchange rate is thus simply the nominal £exchange rate times an adjustment for the relative change in prices abroad and at home. The real exchange rate is a measure of the international competitiveness of a country: changes in the international competitiveness depend not only on changes in the nominal exchange rate but also on changes in the relative price level in the two countries. A real depreciation that can be caused either by a nominal depreciation or a decrease in the domestic price level or an increase in the foreign price level (or some combination of these) will enhance a country’s international competitiveness while a real appreciation will have the opposite impact.

To measure a country’s overall export competitiveness it is often employed a general measure that extends such a bilateral measure into a multilateral measure. This multilateral measure accounts for the fact that trade occurs with many countries. This measure is called the effective exchange rate and is defined as the weighted sum of all bilateral exchange rates. The weight for a bilateral exchange rate is simply the fraction of total trade that the domestic economy conducts with the country. The effective exchange rate can also be adjusted when we are interested in real rather than nominal variables. All we have to do is to sum over all real exchange rates (in index form) rather than the nominal exchange rates.

Trading the Currency Market

Mid-term currency trading offers lower transaction costs and swap earnings (interest paid on the currency borrowed and earned on the one bought) without a substantial risk of losing capital unless very risky crosses are selected. However, the requirements include a deep understanding of market fundamentals, the ability to sustain the short-term and medium-term movements of the currency market, and a sizable account to trade with. An important aid in positon trading derives from the correlations occurring with other financial instruments and resulting from relatively predictable capital flows.

- Swap and fly strategy. The forex market is closed on Saturdays and Sundays, so no swap rate is incurred or earned over the weekend. However, most liquidity providers still apply the swap rules over the weekend. To balance the effect of non-trading activities over the weekend, the forex market books three days of swap on Wednesday. Hence, if you hold a trade over 5 P.M. on a Wednesday evening, you will either incur or earn three times the normal rates.

- Siamese Twins. Take a long position on AUD/USD immediately after China announces better-than-expected data. Indeed, China will start to import more raw materials from Australia. This increase in business gives rise to a stronger AUD. Moreover, good data from China tend to increase speculation on higher-yielding currencies (AUD is one of the highest among the G20 nations) because China has substantially a positive effect on the global economy.

- Oil Correlation with USDCAD. Canada, as one of ten world’s oil producers, exports most of its oil and its economy is severely hit when oil prices decline. Thus, the price of oil may predict the movement of the Canadian dollar. However, remember oil prices can be very volatile.

- Spot Gold against Dollar Index. The U.S. Dollar Index is an exchange-traded index representing the value of the U.S. dollar in terms of a basket of six major foreign currencies( Euro (57.6%), yen (13.6%), pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), Swiss franc (3.6%)). This strategy seeks to exploit the inverse relationship between the Dollar Index and the price of gold.

- Interest Rate Differentials. The correlation between interest rate differentials and currency pairs can be very useful. Interest rate differentials can be calculated by subtracting the yield of the second currency in the pair from the yield of the first. For instance, the interest rate differentials in GBPUSD should be the 10-year gilt rate minus the U.S. 10-year rate. The trade is based on the fact the majority of international investors are yield seekers.

References

Lien, K. (2012). Day Trading and Swing Trading the Currency Market

International Economic Accounts, Bureau of Economic Analysis, US Department of Commerce (http://www.bea.gov/international/index.htm#bop)

The Balance of Payments of the United States, Concepts, Data Sources, and Estimating Procedures, April 1990, Robert A. Mosbacher and Michael R. Darby, Under Secretary for Economics Affairs, Bureau of Economic Analysis.

How BEA Aligns and Augments Source Data From the U.S. Treasury Department for Inclusion in the International Transactions Accounts, July 2006, Survey of Current Business, Bureau of Economics Analysis.

International Monetary Fund, Balance of Payments Yearbook, Washington DC: IMF annual.

International Monetary Fund, International Financial Statistics, Washington DC: IMF monthly.

Balance of Payments Manual, International Monetary Fund, Washington DC. (www.imf.org/external/np/stat/bop/BOPman.pdf)