Macroeconomic Indicators

Macroeconomic indicators are statistics that indicate the current status of the economy of a state depending on a particular area of the economy (industry, labor market, trade, etc.). They are published regularly at a certain time by governmental agencies and the private sector.

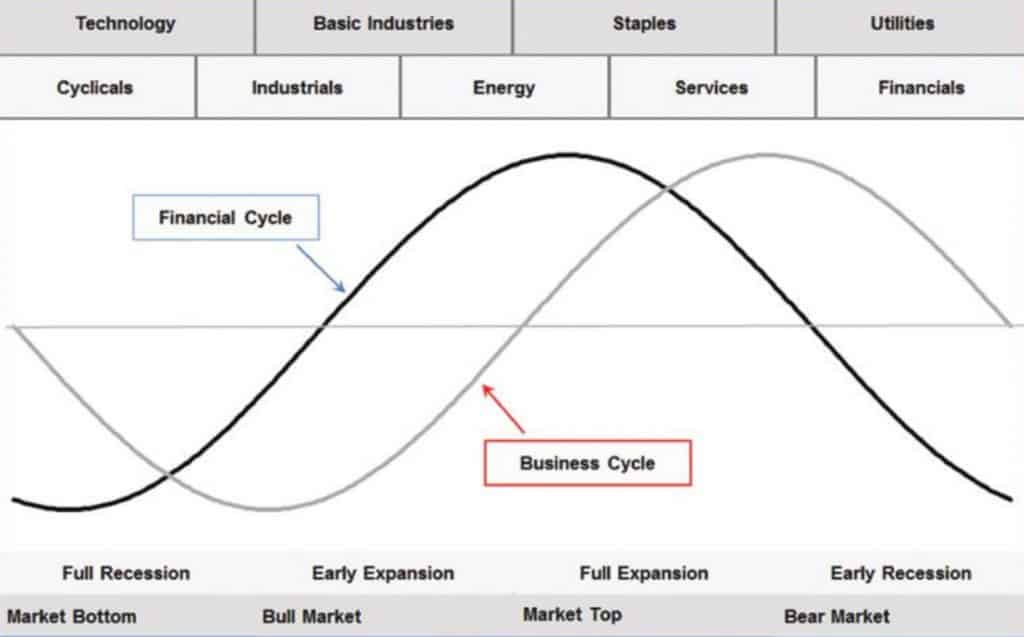

The main point is to get a grasp into the relationship between the macroeconomy and financial markets and the value of equities. Before analyzing individual stocks, it is important to understand the strength and resiliency of the economy. For instance, if macroeconomic indicators suggest that economic growth is contracting and prices do not fully reflect the slowing economy impact on profits, a portfolio cash position should be increased or sector rotation may be considered. Indeed, the results of a macro analysis are employed to identify the current stage of the business cycle for the reason research shows that stocks tend to lead the economy by approximately six to nine months on average.

Most indicators are available for free from the Federal Reserve Economic Data (FRED) database. The Conference Board indicators can be grouped depending on their forecast type:

- Leading Indicators thought to change in advance of economic conditions and used for forecasting the future strength and direction of the business cycle.

- Coincident indicators thought to change in sync with economic conditions and used for interpreting current economic strength or weakness.

- Lagging indicators thought to change after changes in economic conditions and used for corroborating that the economy has been expanding or contracting in accordance with already formed expectations.

The Manufacturing ISM Report

The Manufacturing ISM Report is a survey report based on data provided by supply executives showing the percentage reporting each response, the net difference (positive or negative), and the diffusion index.