Coincident indicators

Coincident indicators are variables tracking the current state of the economy; thus, coincindent indicators are useful to understand the strength and resilience of current economic conditions. Specifically, such metrics are used in conjunction with leading and lagging indicators to get a full view of where the economy has been and how it is expected to change in the future.

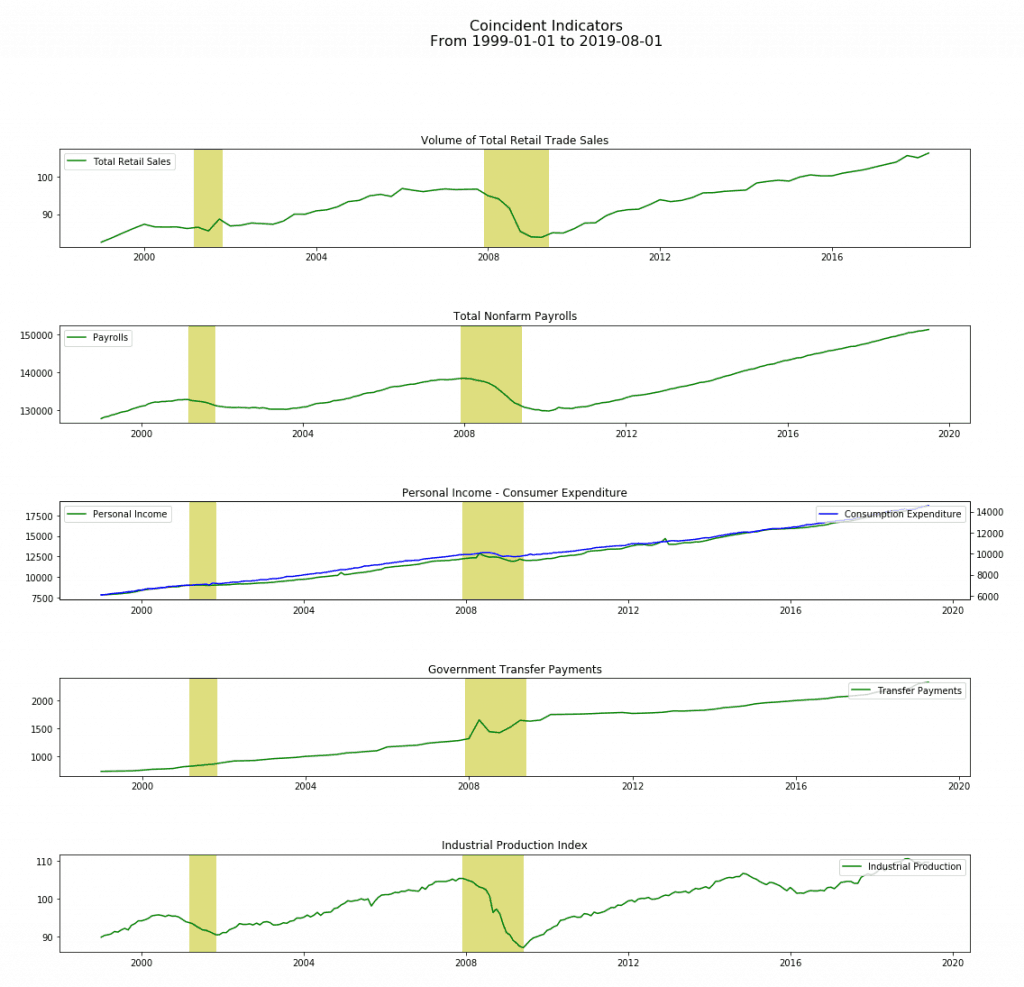

Using the free series provided by the FRED database (series indicated in parenthesis), it is possible to replicate some of the most used coincident indicators of the Conference Board. The coincident indicators can be assigned a weight to facilitate the overall interpretation of each component. My free implementation includes:

- Volume of Total Retail Trade sales (SLRTTO01USQ661S)

- All Employees: Total Nonfarm Payrolls (PAYEMS)

- Personal Income (PI)

- Personal Consumption Expenditures (PCE)

- Federal government current transfer payments: Government social benefits: To persons (B087RC1Q027SBEA)

- Industrial Production Index (INDPRO)

Volume of Total Retail Trade sales

In general, when retail sales are increasing, consumers and businesses optimism determines a positive impact on the present and future economy. Substantially, retail sales are a proxy for consumer and businesses willingness to spend. Weight: 53%.

Total Nonfarm Payrolls

Nonfarm payrolls is the number of workers in full, part-time, temporary or permanent position. Usually, when employment is rising, the economy is expected to expand or at least to maintain its positive trend. Weight: 27%.

Personal Income

A consumer-driven economy has a major contribution to GDP given by the ability of consumers to spend. Personal income is the main source of consumer spending. Weight: 13%.

Personal Consumption Expenditures

PCEs are the amount spent by consumers; usually, personal income and PCEs decrease during recessions

Federal government current transfer payments

Transfer payments are redistributions of tax revenue by the government, including Social Security, welfare, and business subsidies. Personal income minus transfer payments is the measure of income growth from the real economy, that is excluding state intervention. Transfer payments usually increase.

Industrial Production

Industrial production is thought to have a strong positive correlation with GDP; the index measures physical output in the manufacturing, mining, and gas and electric utility industries. Weight: 7%.

References

Weigand (2012). Applied Equity Analysis and Portfolio Management