Assessing the Impact of Modern Monetary Policy on Citizens and Small Businesses

With respect to the COVID-19 impact, it has not passed unobserved that the $3.3 trillion issuance of debt securities in the first half of 2020 has been purchased only by the U.S. Federal Reserve (46%) and national/international private investors (40%); instead, foreign central banks, already holding trillions of dollars of U.S. Treasuries, did not acquire a significant amount. In other terms, it seems the U.S. is substantially moving to own its debt in what we can define a Japanese way of managing the economy; probably, other developed countries will soon engage in similar practices.

What is Modern Monetary Policy?

Modern monetary policy is based upon five theoretical themes recurring in its design, practice, and (dual) mandates of Central Banks:

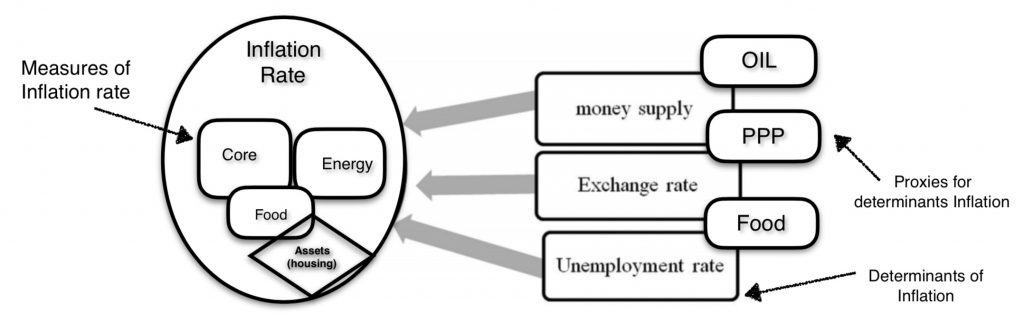

- The Quantity Theory of Money, stating that the money printed by central banks will only result in rising prices and inflation in the long-term without affecting the quantity of output, although it might have some impact in the short-term.

- The Phillips Curve, reflecting the short-term inverse relationship between inflation and the unemployment rate; substantially, it provides the basis for minor adjustments in the short-term.

- The Natural Rate of Unemployment follows from the Phillips Curve; indeed, in the long-term, the relationship disappears and leaves a rate of unemployment (i.e., natural rate) corresponding to the economy’s potential. As a result, the money printed by central banks in an attempt to lower unemployment will only result in rising prices, inflation, and unemployment in the long-term.

- The Rational Expectations Hypothesis, stating the public opinion is able to incorporate a viewpoint of the effectiveness of monetary policies determining specific expectations. As a result, policies resulting in inflation expectations might determine even higher inflation; thus, to target price stability, the central bank must manage expectations.

- The Time Inconsistency Problem refers to the practice of policymakers of changing their policies on-the-go in relation to false incentives in maximizing the public welfare (i.e., influences from the government, lobbies, political factions, citizens’ groups, etc.); instead, an explicit rule for monetary policy allows to maximize credibility and maintain independence by avoiding the retreat from action caused by such false incentives.

In general, the adoption of a specific monetary policy regime is determined by a mix of theoretical developments and historical experiences. In practice, central banks attempt to stabilize inflation to maintain price and economic stability because this is considered a prerequisite for long-term growth.

During 400 years of existence, central banks have changed policies, objectives, duties, and actions; however, after the Gold Standard, other policies had been adopted according to the contingencies of the times and to achieve price stability:

- Exchange Rate Targeting consisted in pegging the value of a currency to the one of a large country (or to a basket of trading partners) proven to have price stability (i.e., U.S. dollar or dollar index for developing countries and the German mark or Euro for developed economies in Europe).

- After Bretton Woods, the Money Growth Rate Targeting approach attempted to maintain money supply growth in line with real economic activity to limit inflationary pressures. However, the policy relies on non-public inflation’s indices and actions.

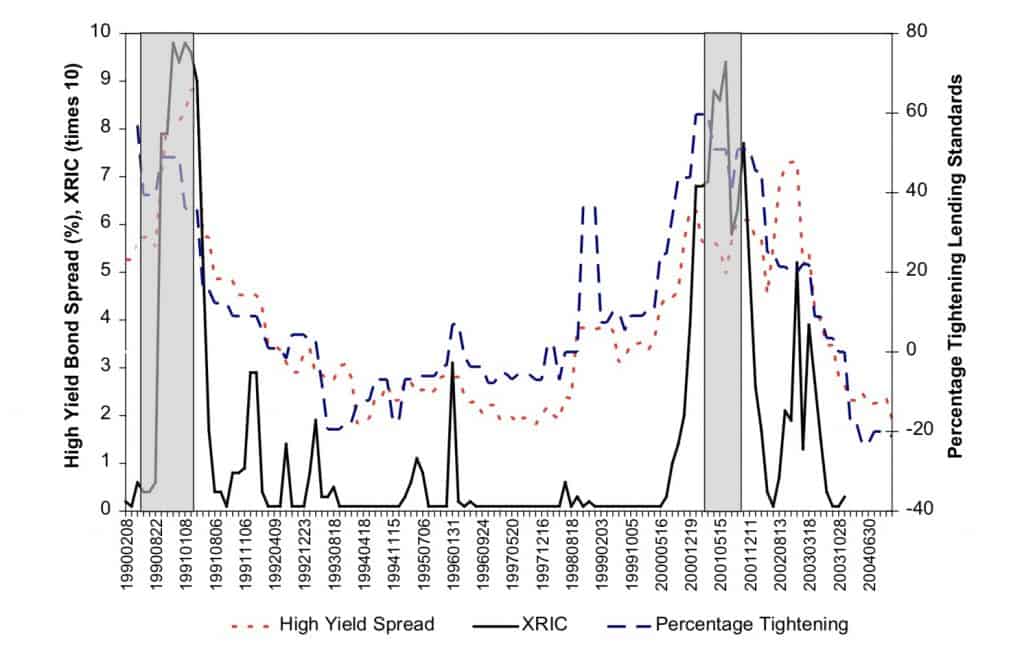

- From the 1980s, to include the impact of unemployment and debt, the Risk Management Approach left the targeting of specific rates to promote an active policy based on economic data, asset prices, and stock market with the aim of acting before an issue could arise (i.e., Greenspan’s adjustment of the short-term interest rate as its policy interest rate during the 1996’s stock markets’ exuberance).

- After the 2007 financial crisis, Inflation-Targeting became the general rule (i.e., a short-term interest rate is set as the policy interest rate to adjust the monetary conditions in the economy to maintain the forecast for inflation in line with its target). The approach is based on transparency (i.e., public announcements) and accountability (i.e., responsibility) to maximize its credibility for stability.

- After economic shocks deriving from the global financial crisis (2007-2010) in the United States, Euro, UK, and Japan (1990 assets bubble), the Unconventional Monetary Policy has been adopted. In general, a nearly zero policy interest rate is complemented with a) loans to financial institutions, b) liquidity to credit markets (overnight, repos, etc.), and c) purchases of government and private long-term securities with the aim of stimulating the economy and avoid a deflationary spiral (as in the case of Japan). The first two tools are used at the peak of the crisis, whereas the latter has become a form of (unconventional) monetary policy known as Quantitative Easing.

Unconventional monetary policy has fostered a debate whether a prolonged Quantitative Easing (i.e., a systematic and sustained purchase of government’s securities) may imply a central bank’s impact on the fiscal policy of a country and promote asset-price speculation. In the former case, by effectively printing money to finance the debt of private and public institutions, the independence and credibility are undermined. In the latter case, the liquidity pumped in the financial system before the deleveraging of the involved institutions is channeled into the equity markets (and developing economies) to sustain the existing debt instead of being conveyed into real economic activities. Instead, the purchase of private securities (i.e., MBS, ABS, etc.) might distort the economy for the reason central banks are helping the private firms holding depreciated/toxic assets rather than virtuous companies. Finally, it is not clear how to unwind quantitative easing without affecting inflationary pressures and, in turn, central banks’ credibility; in general, a gradual tapering has been suggested.

Impact of Monetary Policy Implementation on Investors and Consumers

Central banks operate in the money, foreign exchange, government securities, and credit markets. The money market is the market place for short-term borrowing/lending of various entities including commercial banks; specifically, the policy interest rate, open market operations, and standing facilities can influence the commercial banks’ reserve balances held at the central bank as well as can transmit the managed short-term money market interest rates to other interest rates maturities substantially affecting the changes in the yield curve (i.e., a measure of investment risk). While monetary policies generally affect the short end of the yield curve, the current zero policy interest rate often employ quantitative easing to influence also the longer end to reduce volatility at the longer maturities and suggest an improving and stabilized economic environment.

The effects of monetary policy (i.e., higher interest rates) are transmitted through the credit channel (i.e., additional costs passed to households) and the balance sheet channel (i.e., reduced assets because of lower prices) that, in turn, operate through financial institutions (i.e., considering loans riskier and reducing the supply of credit); however such transmission is indirect and involving various steps, resulting in different time lags. Among the various effects of monetary policies, some have an impact on households, whereas others have it on firms. On the one hand, the decisions of citizens are affected by the intertemporal substitution (i.e., delaying consumption of durable goods to increase savings), income (i.e., reducing disposable income), wealth (i.e., reducing the wealth of household through asset prices), exchange rate (i.e., favoring foreign goods), expectations (i.e., economic slowdown), and second-round (i.e., the effect of the first reaction of households on the economy) effects. On the other hand, firms are affected by the funding costs (i.e., higher debt costs), asset price (i.e., reducing their value), exchange rate (i.e., increasing flows in the county strengthen the currency), expectations (i.e., cutting expenses and jobs), and second-round effects (i.e., considering moves for the subsequent expansion).

Why it Does Not Work Well for the Average Citizen and Small Business

While central banks’ mandate and intentions can be considered pure and finalized at maximizing the public wealth, the general understanding of their effects and outcomes are, in practice, near-zero as their policy rates. Moreover, the effects are often instrumentally employed by informed entities to capitalize on misinformed citizens and small business owners. For instance, productive assets (i.e., house, warehouse, flat, etc.) of prime nature acquired with hard work using leverage cheaply provided by financial institutions sustained with public funds through quantitative easing are often eyed by informed agents that during the crisis literally strangle owners to buy such assets discounted by 40-50%. Similarly, lending occurs through privileged channels well before the onset of the policy measure with the result of misinformed companies substantially deprived of the access to credit. For instance, short-term lending for managing the working capital of small firms is suddenly reduced because the parameters of the balance sheet are not in agreement with the provisions required by central banks unconventional policies to sustain the financial institutions involved in such short-term lending. Finally, it is a mystery the forecasting abilities of some informed entities renegotiating their debt instruments after various political meetings occurred in international venues…

References

Basistha, A., Kurov, A. (2008). Macroeconomic cycles and the stock market’s reaction to monetary policy. Journal of Banking & Finance 32

Moenjak, T. (2014). Central Banking. John Wiley & Sons Singapore Pte. Ltd

Putnam, B. (2020). Implications of US Borrowing $3 Trillion in H1 2020. Https://www.cmegroup.com/education/featured-reports/implications-of-us-borrowing-3-trillion-in-h1-2020.html