The 2021 Recovery

From the Balance of Payment it is possible to understand the amount and direction of the net capital inflow (or outflow). Indeed, making an educated guess on the new locations for investment and trade may make the difference in investing after the epidemic.

The Accounts

The balance of payments shows the sum of the transactions between individuals, businesses and government agencies between a country and the rest of the world. From the BOP it is possible to understand the amount and direction of the net capital inflow (or outflow). Usually, net outflows are typical of countries politically fragile or subject to dangerous devaluations.

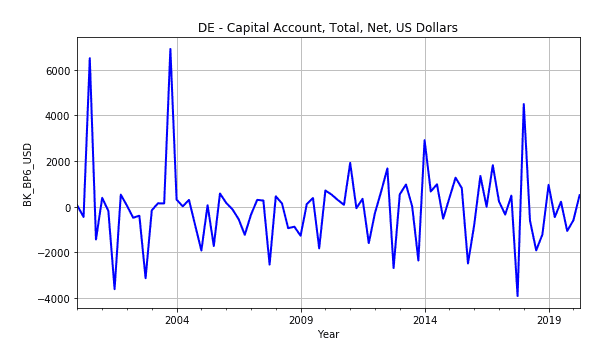

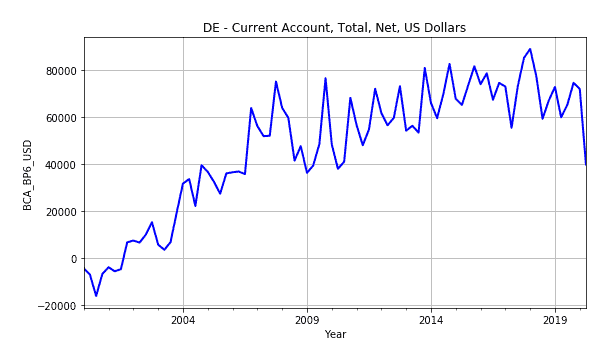

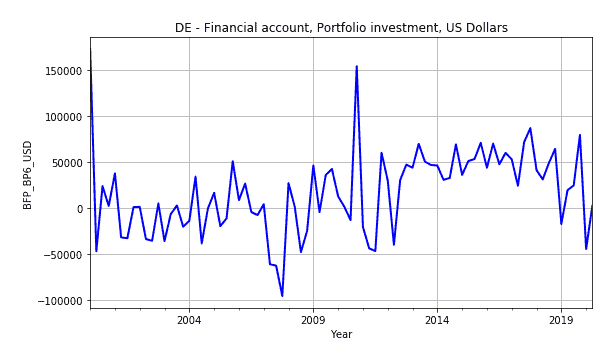

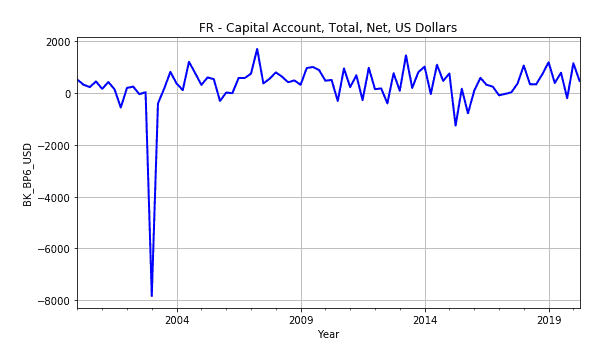

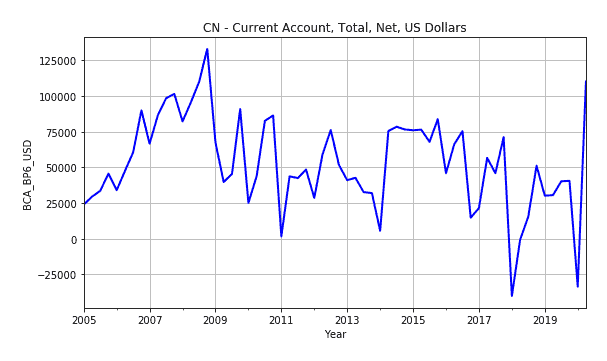

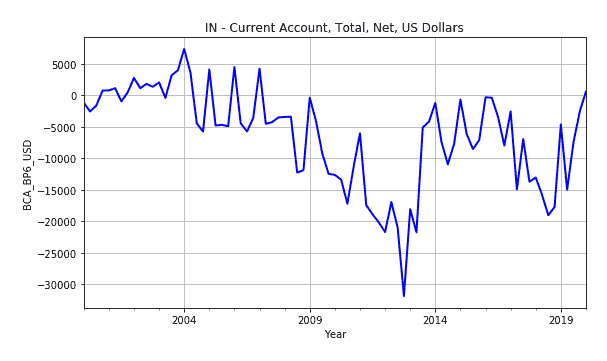

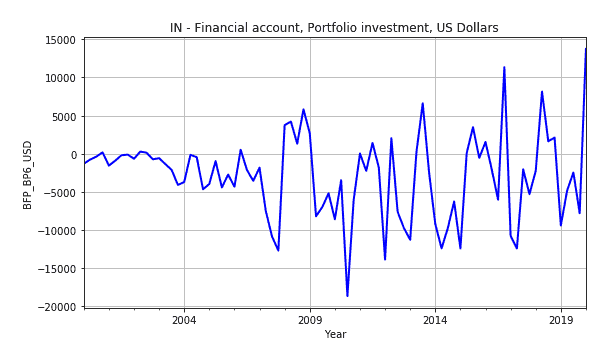

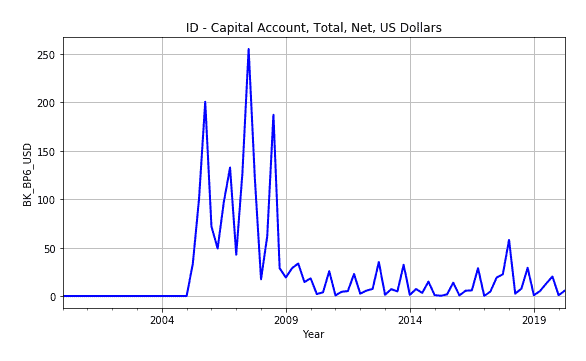

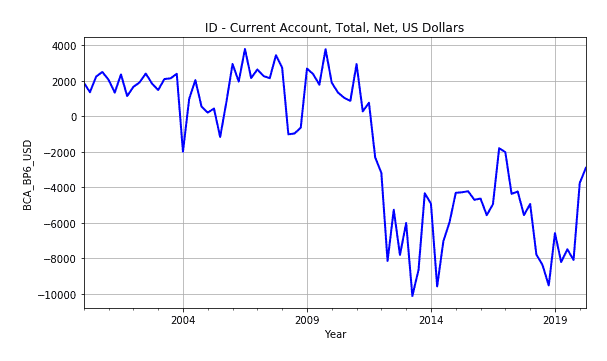

Thus, by looking at the historical series of the current account, it is possible to understand the trend in international trade (and earnings on investments). Similarly, the capital account may shed light on capital transfers and the acquisition foreign-produced non-financial assets.

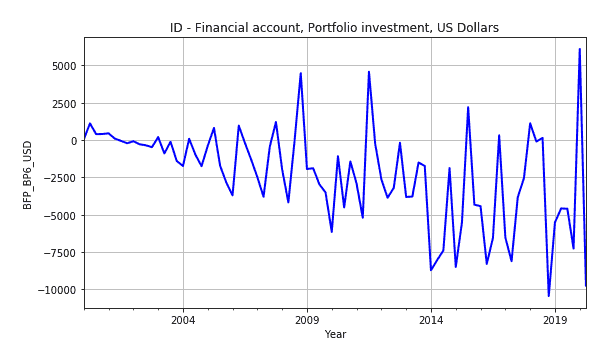

When a country buys more goods and services than it sells (a current account deficit), it must obtain the difference by 1) printing new money, 2) borrowing, or 3) exporting more capital assets than its imports (a capital account surplus).

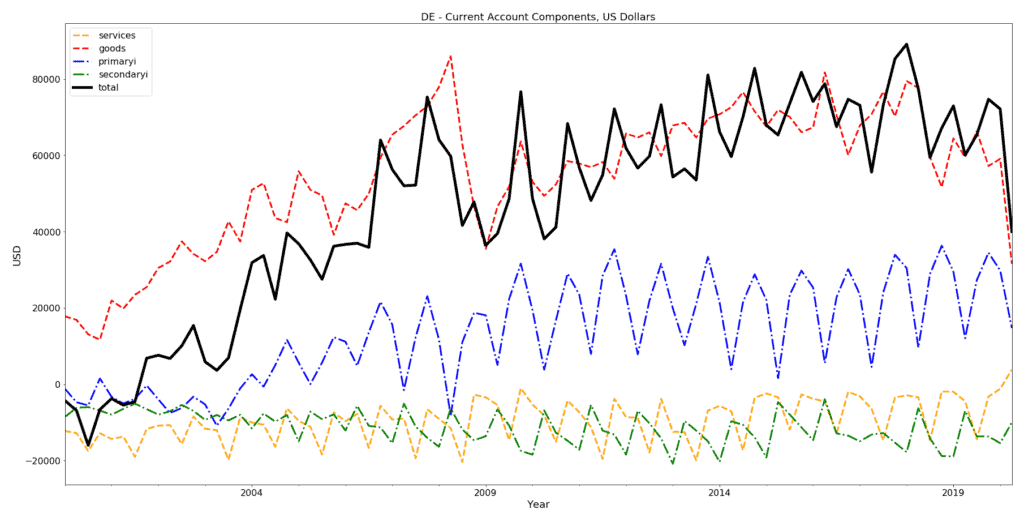

Developed Countries

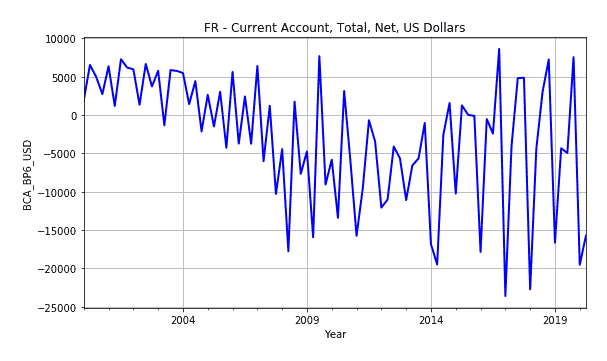

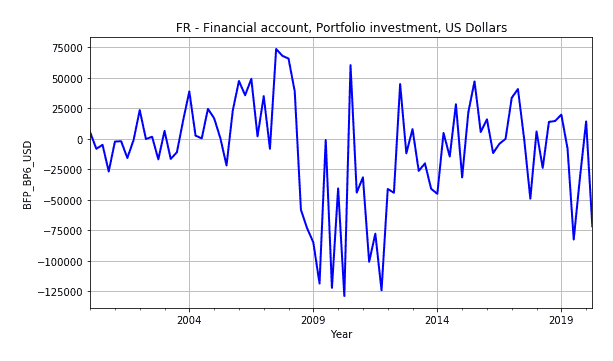

Apart the United States (already considered in this post), France and Germany are well ahead of the other European countries with stable capital accounts and improving current accounts:

Germany

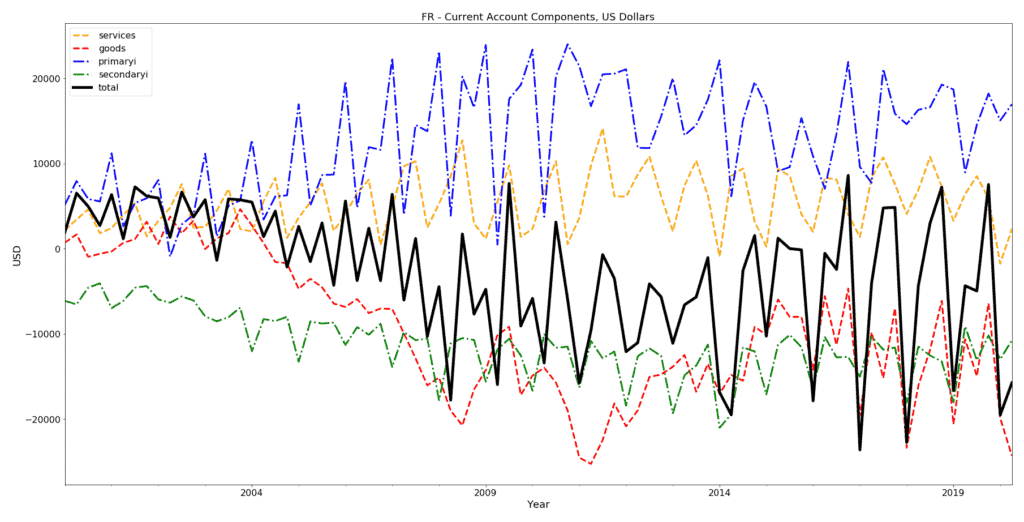

France

Developing Countries

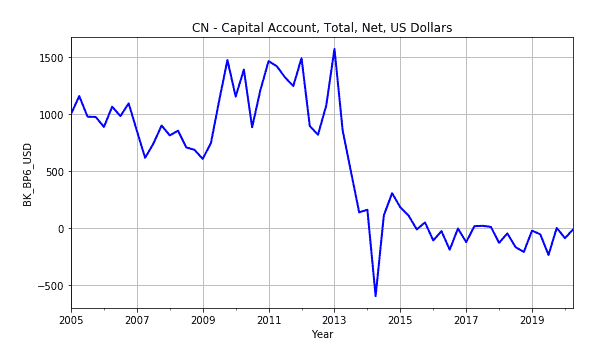

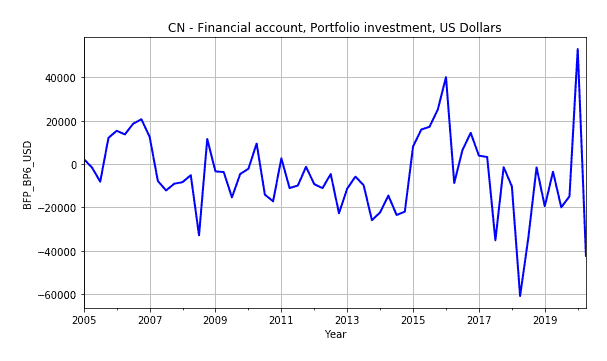

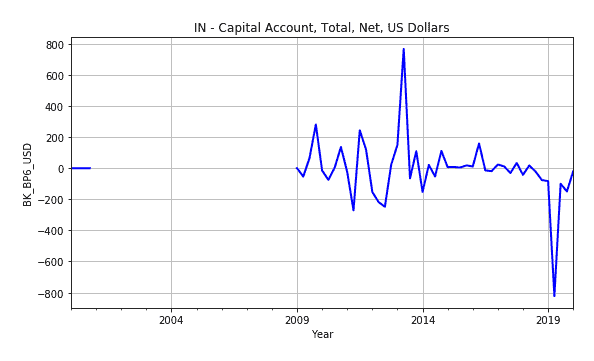

Emerging economies are led by China, India, and Indonesia; however, as characterized by higher risk, it is evident a reduction in financial capital:

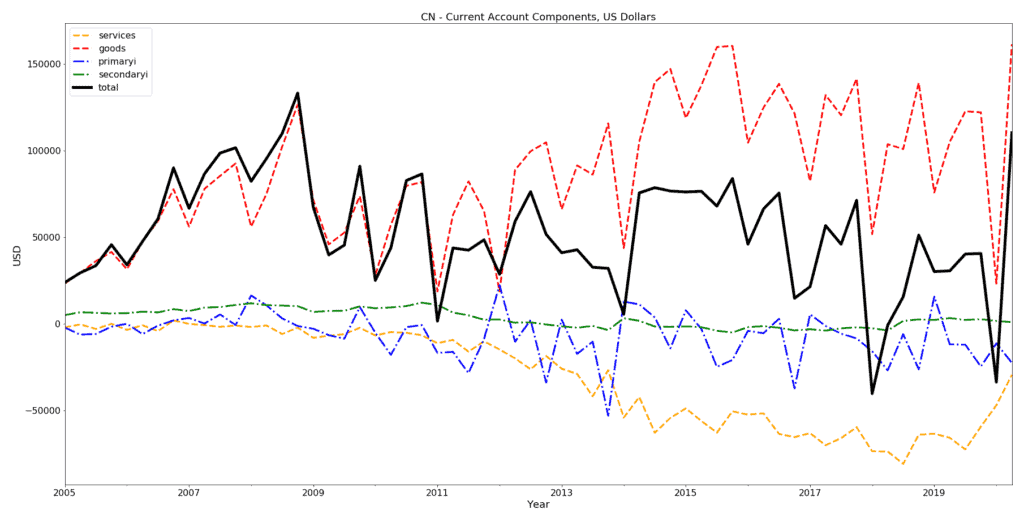

China

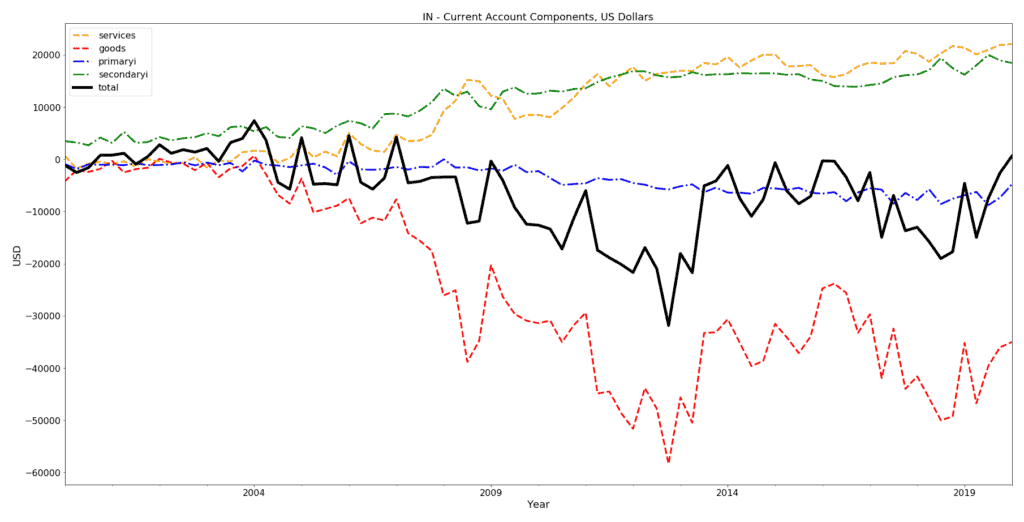

India

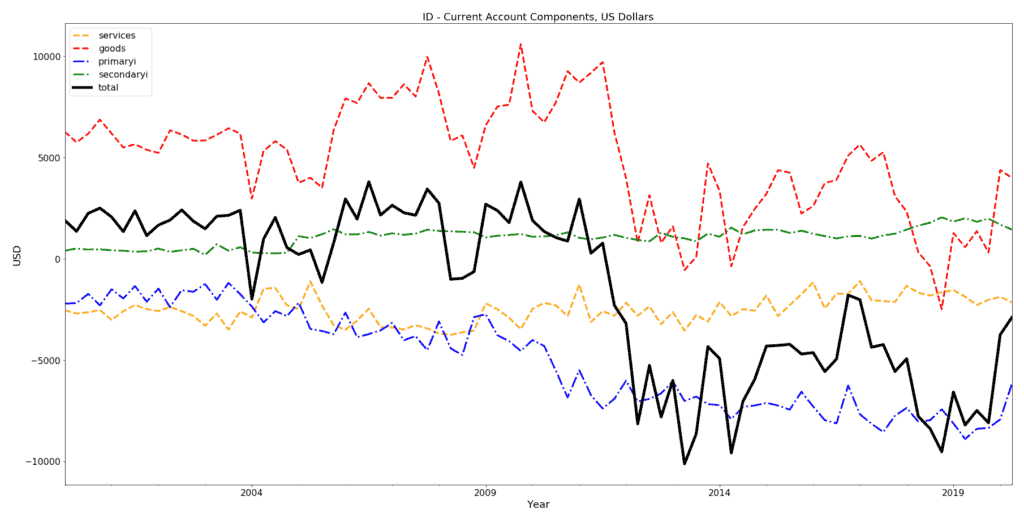

Indonesia

A Future of Higher Debt

While in developed countries the Central Banks have successfully stabilized the economies and paved the way for the recovery of 2021 and 2022 (at least in central Europe and North America), rates will remain lower for longer. As a result, investors will look at developing and least developed countries in Africa and Asia to improve their returns. Specifically, because international trade has a large and positive impact on economic growth in developed and developing countries but not in the least developed ones (i.e., Africa and Asia ex-China), trade channelled through foreign direct investment leveraging the adoption of new technologies (i.e., 4G in Nigeria) and promoting the integration within regional and global value chains (i.e., industrialization in Vietnam) will result in strong growth in such LD countries.

And a Present of New Technologies for Greater Productivity?

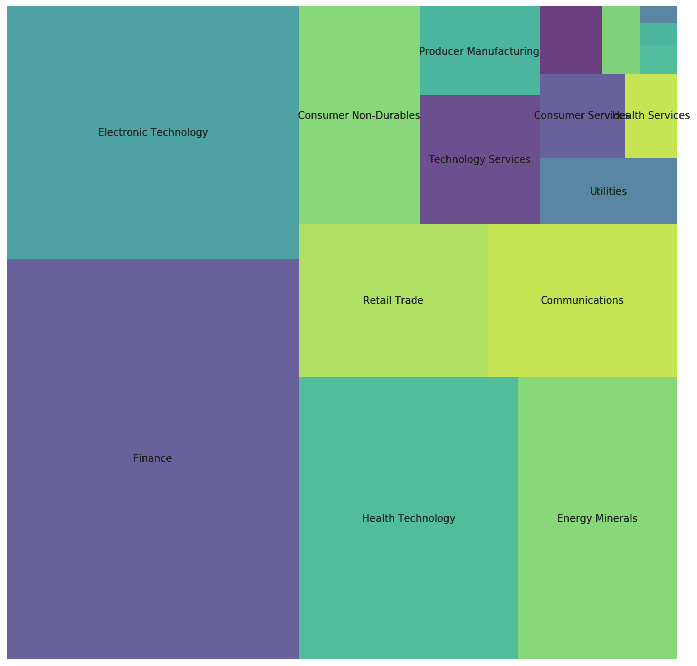

Similarly, such themes (i.e., automation and digitalization in traditionally human intensive sectors like automotive, healthcare, and financial services) will surely recur in Europe and United States; however, in this case, only increasing capital expenditures will signal in the next months the re-start of the economies. In the mean time, investors are looking ahead and rotating as shown by the 10 Days Average Volume by sector (IEX Cloud data):

References

IMF (2019). The Balance of Payments Manual. Retrieved from https://www.imf.org/external/np/sta/bop/bopman.pdf

Were, M. (2015). Differential effects of trade on economic growth and investment: A cross-country empirical investigation