Earnings and Events

Several studies have shown that knowledge about past and future earnings can lead to investors earning superior returns despite ambiguity in measuring earnings. Earnings reports are always among the most significant events for traders and investors for the reason over the short and long term stock prices track changes in earnings. Other relevant events include Non-Farm Payroll Report (NFP), FOMC, Central Banks interest rate decisions, and Forex news

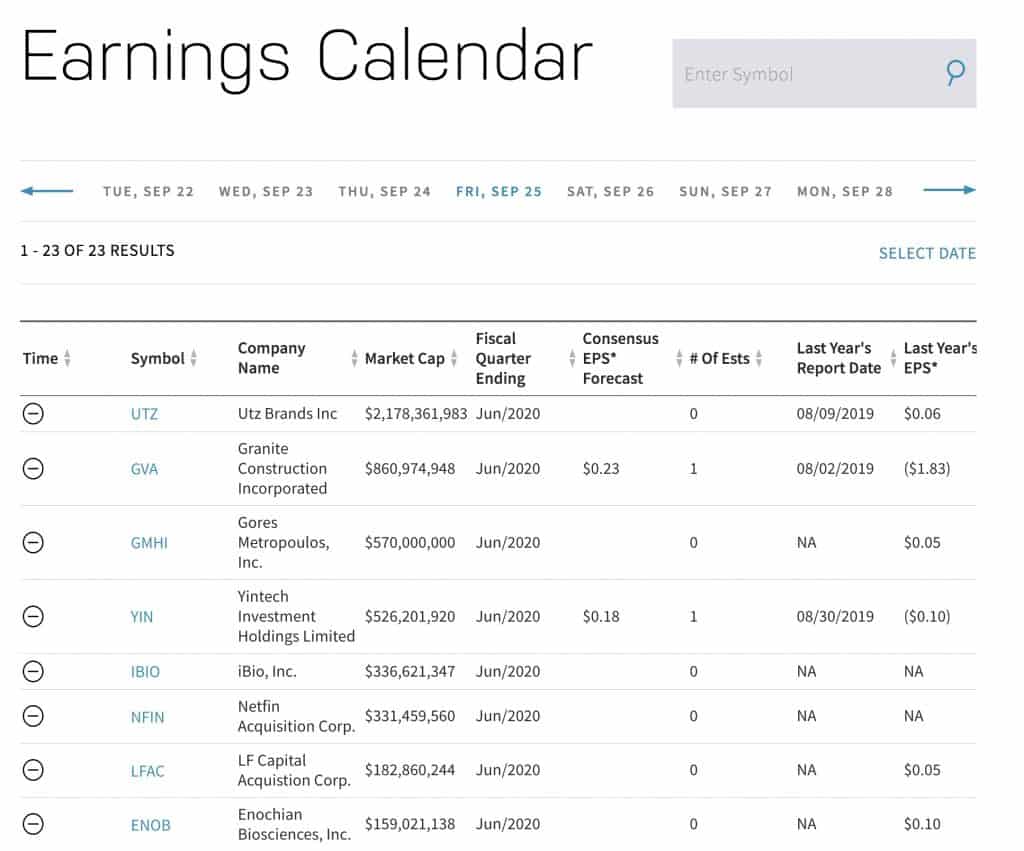

Earnings Announcements

Persistence captures the permanence of an earnings change, that is, how much the earnings change continues to the future. The more persistent is an earnings change, the greater is its impact on the entire future earnings series; additionally, researchers have also shown that past accounting data can forecast future earnings. However, traders usually employ a specific strategy to trade earnings. Post-earnings announcement drift, or PEAD is the tendency for a stock’s cumulative abnormal returns to drift for several weeks (even several months) following a positive earnings announcement. It is an academically well-documented anomaly first discovered by Ball and Brown in 1968 and since then it has been studied and confirmed by countless academics in many international markets.

Economic Events Releases

According to Metatrader‘s website, an Economic Calendar “is an indispensable tool for fundamental analysis of financial markets based on economic news”. Indeed, when actively trading the market with a percentage of your portfolio, many events that are potential market movers can be anticipated and planned for—to some extent. The Economic Calendar lists economic reports releases along with the scheduled time of the release and a grade of the market impact.