Oil or Turmoil?

The economics of crude oil pricing is one of the most complex and variable mechanisms in the commodities market; indeed, as a depleting non-renewable resource, its cost of extraction depends not only on the current rate of production but also on the amount of cumulative production. In this sense, the low-carbon transition is driving rapid change across global energy systems. The oil sector must invest and adapt to decarbonisation. Refineries can convert into renewable plants, making biodiesel or biojet fuel.

Oil Uses and Production

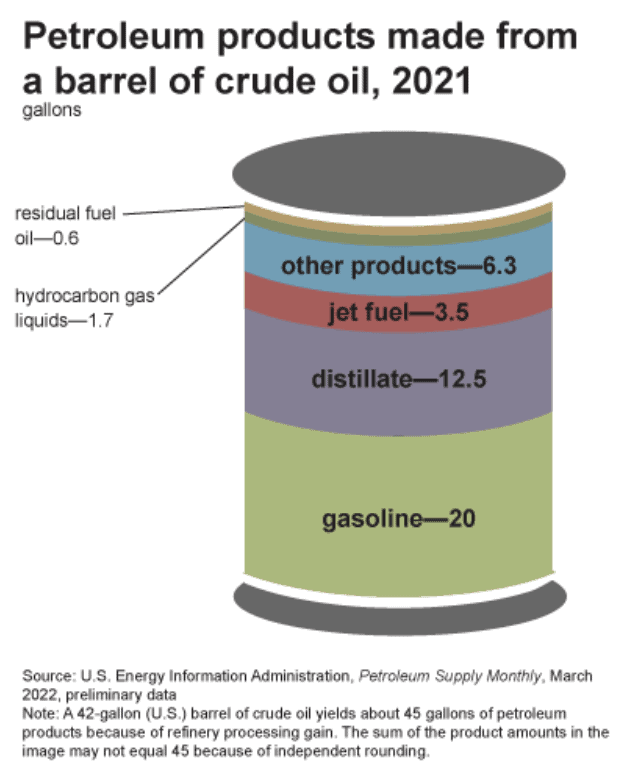

Today, most crude oil is refined into gasoline, distillates such as diesel fuel and heating oil, jet fuel, petrochemical raw materials for other industrial processes, waxes, lubricating oils, and asphalt. For the most curious, the use of asphalt by the Babylonians is documented since 1500 to 538 BC for reinforcing wall corners and joints (i.e., the temple tower of Ninmach) and for building vaults or arches. Similarly, Egyptians used asphalt to fill the corpse cavities and to coat the cloth wrappings.

Conventional production generally means that crude oil and natural gas flow to and up a well under the natural pressure of the earth. Unconventional production requires techniques and technologies to increase or enable oil and natural gas production beyond what might occur using conventional production techniques. Interestingly, most US oil is extracted with unconventional techniques. Further, refineries have three basic steps: separation (i.e., piping crude oil through hot furnaces), conversion (i.e., processing the previous heavy, lower-value distillation fractions into lighter, higher-value products such as gasoline), and treatment (i.e., combining a variety of streams from the previous stages).

The Drivers of Oil Prices

In general, the most relevant factors influencing the price of crude oil (and perhaps of oil economics) are a combination of :

- Availability from the reservoir

- Quality

- Extraction

- Again quality

- Geopolitics

Quality is affected by catalyst performance; indeed, refiners can increase yields of top-quality base oils from a variety of feed slates ranging from vacuum gas oils, deasphalted oils, to unconverted hydrocracker bottoms. Specifically, heavy oil is widely believed to be the most important unconventional resource because of its tremendous reserves around the world. However, the exploitation of this type of energy source is still complicated in both recovery and transport stages due to their high viscosity and density, in addition to having a high content of resins and asphaltenes (for the joy of Babylonians, Egyptians, and Romans). With respect to ecological concerns, capture materials and CO2 dehydration provide the technology to separate, dehydrate, transport and store carbon dioxide to reduce harmful greenhouse gas emissions.

Oil Prices

From a theoretical perspective, the theory of storage (i.e., the marginal convenience yield on inventory falls at a decreasing rate as aggregate inventory increases) is the most used model of commodity futures prices; indeed, although developed for commodities subject to seasonal variation in supply (i.e., harvest), it is valid also for commodities subject to other supply and demand seasonal fluctuations. The theory suggests that futures prices are largely determined by demand and supply conditions in spot markets with many confirmation about the forward looking character of futures markets. Further, daily spot-month crude oil, heating oil and unleaded gasoline futures prices can be modelled as a cointegrated system with the cycles of crude oil and heating oil prices coinciding with the industrial production cycle, while those of unleaded gasoline and natural gas lag the cycle of industrial production. Similarly, energy prices are positively contemporaneously correlated with consumer prices and their cycles lead the cycle of consumer prices, suggesting a possible role for energy prices in the conduct of monetary policy; last, there is bidirectional (linear and nonlinear) causality between natural gas and electricity prices.

In summary, by considering practical and theoretical aspects, the following factors can be considered (as of August 2022):

| Upside | Downside |

|---|---|

| OPEC+ struggling to increase prices | Lockdowns in China for zero-Covid |

| EU embargo of Russian oil | Dollar strength |

| Air travel restrictions | Global reserves releases |

| geopolitical factors | Resolving of geopolitical issues (Iran) |

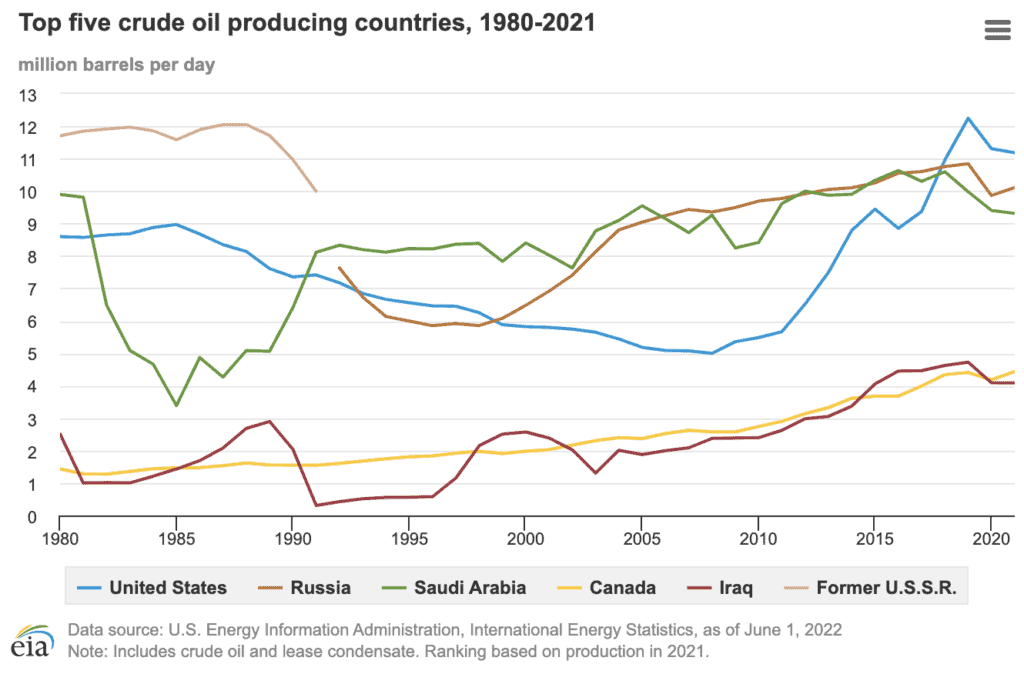

| unexpected close-downs | Increasing US shale production |

Exposure to crude oil dynamics can be efficiently gained through crude oil futures on the WTI crude oil, the world’s most liquid oil contract. WTI Crude Oil futures are the most efficient way to trade the light, sweet crude oil blend after a sharp rise in US crude oil production but can also be used for hedging to minimize the impact of potentially adverse price moves on the value of oil-related assets, or even for speculation on oil price movements with maintenance margins inferior to 1000 USD on micro futures and options contracts.

Oil Term Structure

The forward curve represents the term structure of a commodity. Some traders call the forward curve or term structure a calendar spread, but all three names amount to the same thing which is an understanding of the prices for delivery of a commodity at different time periods. Look at the data as of 22 April 2022:

Oil Volatility

Swings in the price of oil can have important effects on companies and economies; indeed, extended periods of volatility can impact government budgets and alter geopolitical priorities. For traders, oil spread are a nice way to reduce the impact of volatility. Look at the data as of 22 April 2022:

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil (as of 22 April 2022):

References

Apostolos (2007), Quantitative and Empirical Analysis of Energy Markets

Speight (2011), An Introduction to Petroleum Technology, Economics, and Politics

Bloomberg (2022), Catalysts for the Price of Brent

CME (2022), Crude Oil Futures and Options