Oil Correlations with Commodity Currencies

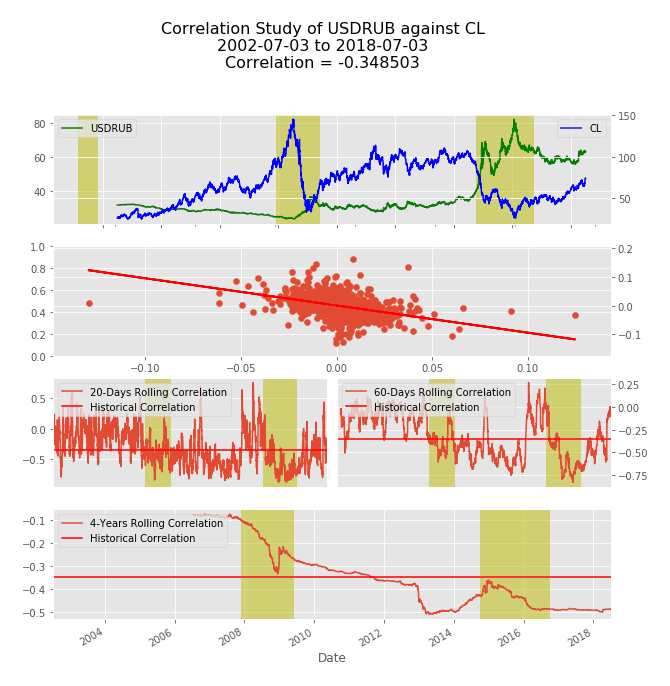

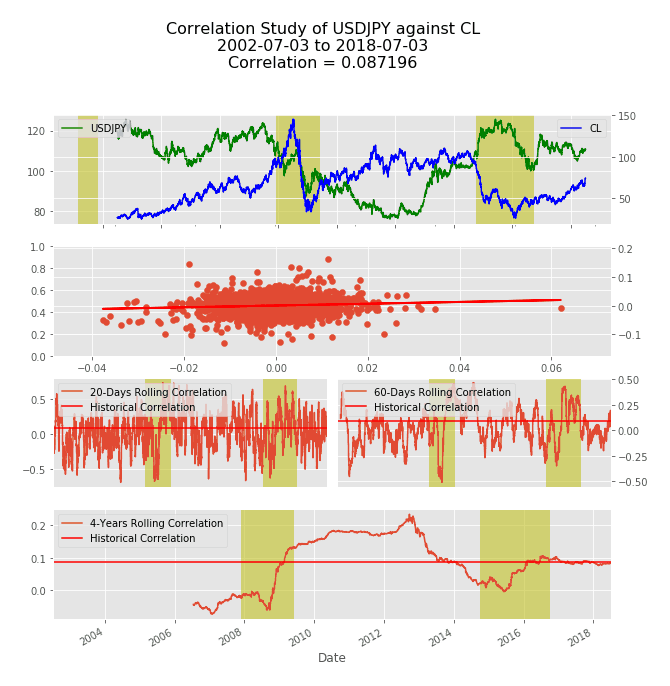

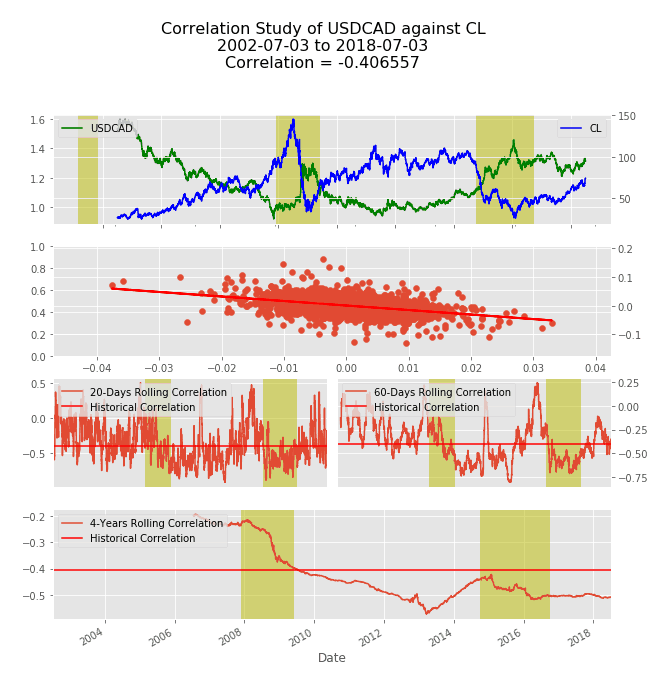

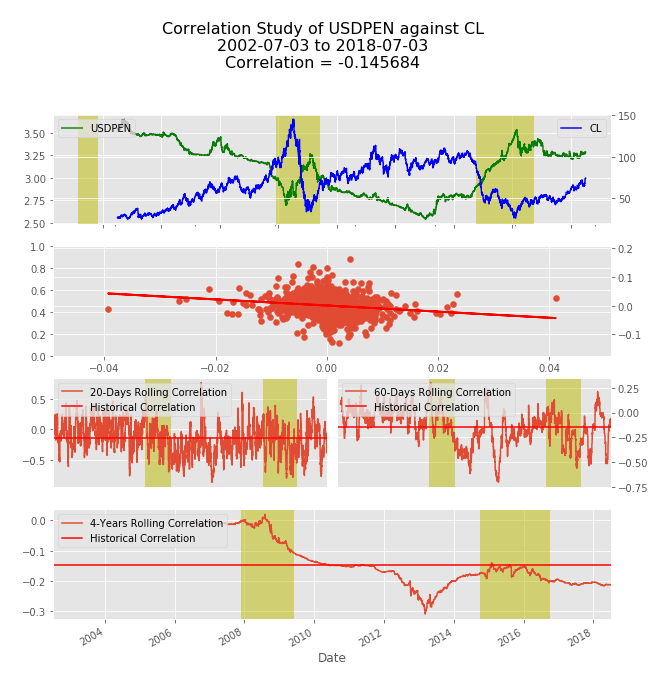

Oil correlations with currencies are also dependent on supply and demand, politics, interest rates, speculation, and GDP. It is accepted that whenever growth in a country is mainly commanded by commodities exports currencies are generally correlated with commodity prices. Major commodity currencies include the Australian Dollar, the New Zealand Dollar, the Canadian Dollar, the Japanese Yen, and the Swiss Franc. Minor currencies include the Russian Ruble, the Colombian Peso, and the Peruvian Sol.

Economic Factors Behind Oil Prices

According to the New York Fed, the decline of oil prices since 2014 may reflect either demand or supply shocks; the former suggests a slowdown in global economic activity whereas the latter may pint to a forthcoming boost in spending as firms and households benefit from lower energy costs. Overall, between 2014 and 2017, both lower global demand expectations and higher anticipated supply held oil prices down. In 2018, strengthening global demand expectations drove oil prices higher until 2018:Q4 when demand decreased. In 2019:Q1, oil prices rose due to increasing demand expectations. Finally, in 2019:Q2, oil prices fell due to increasing supply.

Correlations with Currencies

A decrease in demand causes prices to fall, a drop in prices triggers a loss in confidence, a loss in confidence sees investor sentiment wane, and a weaker commodity currency is the result. Such an effect is also present in the correlations of commodity currencies with crude oil, showing a strengthening of correlation when oil price increases. Moreover, a general flattening of the 4-Years rolling correlation usually precedes price inversions, probably because of the combined effect of a lag between orders and exchange adjustments and the slowdown effect on the currency. A simple confirmation can be obtained by computing the correlations in Python:

References

“Is Cheaper Oil Good News or Bad News for the U.S. Economy?” Liberty Street Economics, June 8, 2015.