Guessing Market Cycles

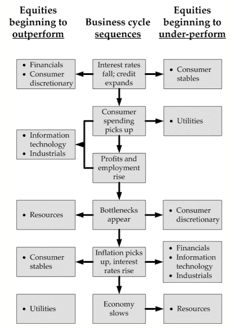

Market cycles can be analized through the formation of bubbles consisting of four phases: Accumulation, Mark-Up, Distribution, and Mark-Down. Usually, accumulation coincides with the early stages of recovery, mark-up with the consolidation of the economic condition leading to a bullish sentiment, distribution substantially with lateral movements and indecision in market sentiment, and mark-down with the early stages of mid recession.

According to Tvede, a business cycle can be considered the result of overlapping components like inventory cycles, capital investment cycles, and property cycles determining asset bubbles and a sort of systematic bubble rotation. Several signals can be identified during the main cycle:

- monetary accelerator, a monetary expansion happens when real rates go below natural rates (Wicksell) and/or money supply increases above trend. This leads to optimism, activity, asset appreciation, and therefore also (after a delay) to acceleration in the velocity of money (Cantillon, Thornton, Friedman, etc.);

- inventory accelerator, low inventories induce companies to order more. This creates increased overall growth, which means more sales, which further depletes inventories;

- capital spending accelerator, bottlenecks in mature expansions force companies to build more capacity (Aftalion, Clark, Juglar, etc.). This creates more growth, which means that they have to build even more capacity;

- collateral accelerator, rising asset prices (von Mises, von Hayek, Schumpeter, Minsky, Kindleberger, etc.) create added collateral value. This enables more borrowing, which stimulates business, which is good for asset prices (Bernanke, Gertler and Gilchrist, etc.). This has the largest impact when it happens in property markets (Hoyt, Burns, etc.), but is also significant in equities;

- emotional accelerator, rising asset prices will, at a given stage, capture the imagination of unskilled investors;

- exhaustion, a boom creates bottlenecks in labor, physical resources, and credit, which eventually make further growth in private spending impossible and new business unprofitable (Hawtrey, Tugan- Baranovsky, Kassel, Hobson, Catchings, Foster, Pigou, Keynes, etc.);

- credit crunch, working usually in recession only, significant contractions may lead to debt deflation and/or liquidity traps (Fisher, Minsky, Kindleberger, Keynes, etc.).

- money rates and bond yields drive residential property markets because they drive their affordability, and this leads to private wealth gains, which again drive prices in jewelry and collectibles; moreover, bonds drive equity markets because interest rates are used as the discount factors for future earnings. Bonds also drive economic activity, which drives everything.

The average length of cycles can be considered relatively stable over time and across economies (Schumpeter, Forrester, Mosekilde, etc.) synchronizing into a neat pattern with four inventory cycles and two capital spending cycles within each real estate cycle: inventory cycle last 4.5 years; capital spending cycle takes nine years; property cycle is completed in 18 years.

The Expansion

At the beginning of an expansion, long leading indicators like bond prices, real money supply, new building permits and the ratio of prices to unit labor costs began rising some eight months before our first pick-up in GDP. The other leading indicators have also turned up, but some of them just a few months before activity. Unemployment is high, but the overwhelming majority is still working, and their savings are actually piling up. Loans have gotten cheaper, and some are therefore beginning to spend a bit again. Sales volume of residential real estate is rising rapidly, and property prices start ticking gently upwards soon after. The equity markets are also rising, and much faster than property prices. They had been hammered at the beginning of the downturn, and it is now dawning on the smartest investors that many of these shares are completely underpriced. Smart investors buy consumer discretionary, financials, and information technology. The monetary accelerator is clearly kicking in as velocity of money rises. Property prices, meanwhile, are continuing upwards, and homeowners refinance their mortgages at lower rates while booking profits on the financial portfolios. Consumer confidence rises and more people head for the shops – and for the car dealers. Prices of aluminum and lead – two metals widely used in cars – pick up. The surge in demand takes some companies by surprise, as their inventories dwindle, then ordering increase to rebuild levels, leading to more growth, the inventory accelerator.

Companies have still considerable spare capacity, and can meet this new demand with their existing work-force, boosting revenues without adding cost; profits surge dramatically. Companies that have been suffering throughout the recession finally feel that they have a bit of pricing power, and so a wave of price hikes hits the economy. Central banks watch this with considerable concern, thus they hit the brakes: they raise rates and the monetary accelerator goes into reverse after a while. Some investors get concerned too. Bonds peak out and start falling modestly. This happens at approximately the same time that companies reach satisfactory inventory levels, and the deceleration of inventory creates ripples through the economy, which slows down for a while: the inventory accelerator has gone into reverse. It has now been 4.5 years since the expansion started. All of this has one very positive effect, though: it brings inflation back under control within a matter of months. Central banks see that core CPI (consumer price inflation) is falling below their target rate, and as the PMI (purchasing managers’ index) goes below the neutral reading of 50, they decide that enough is enough and go on hold. Six months later they start easing. Bonds turn up again, with equities following and even before economic revival stock markets reach new highs. Residential property prices rise again as people take advantage of the new fall in mortgage rates.

The first inventory cycle is complete, leaving very little impact on gold, diamonds, private equity, and collectibles, while the first inventory cycle has played out, there has been a slow, but significant, change in one key indicator: capacity utilization has gradually been moving upwards. Although capacity utilization stalled during the brief decline of the inventory cycle, companies have largely been able to meet demand by using their existing capacity plus asking their staff to run faster – or by hiring more. They have used much of what they have earned to improve balance sheets after the deep recession that ended 4.5 years before. Banks have written down all their bad debts, and companies have paid down their loans to levels that are now better than safe. They begin to invest in R&D, and also in new production capacity. This wave of investments triggers the capital spending accelerator, as companies sell production capacity to each other. The increase in capital spending is extremely welcome in the commercial real estate sector, which has remained stubbornly slow until now. Rentals are now improving, and vacancy rates in the best offices (downtown) fall from medium to almost nothing, and some new tenants have to settle for the less attractive suburban offices. Industrial property is also picking up now, as new capacity is being built. Capacity building is at this point taking over from consumer spending as the main driver of overall growth, the emotional accelerator has kicked in. Wealth is now growing rapidly and assets are used as collateral for loans: the collateral accelerator is at work. And so is the monetary accelerator, as the velocity of money accelerates and business invents new forms of credit to meet soaring demand.

Market share is now the key priority in most companies, and a wave of mergers and acquisitions follows. Meanwhile, metals and mining producers find it hard to keep up the pace and react by raising their prices, whilst they prepare for new production capacity. It will take several years before most of that capacity is effective, though. Commodities like copper, aluminum, and lead do well, and zinc and nickel may do even better; there is, after all, a lot of this stuff in engineering applications, wires, chemical industry plumbing, etc. Hedge funds managers thrive since they see soaring earnings and firm, tradable trends. So do private equity funds, which can exit many of their investments at excellent, if not exorbitant, prices. And gold, diamonds, and collectibles re doing very well. Business is generally very good now, and the inventory accelerator is again contributing to the party. But a problem is gradually emerging: costs seem to be spiraling everywhere. Commercial property rental is getting more expensive, for instance, as lease agreements come up for renegotiation. Companies are also, for the first time, experiencing serious wage pressure for many categories of skilled labor. Demand is high, but supply is tight, so whereas corporate top-line growth is fine, the bottom line begins to lag behind: the exhaustion phenomena are emerging. This is the point where central bankers get worried and start raising rates. Bonds go into decline. Industrial metals are still rising for a while longer.

The Contraction

Long leading indicators tend to turn approximately 14 months before the peak of activity. This is the inflection point that leads to the first, serious recession in nine years; one that combines a collapse in capital spending with a serious correction in inventory levels. Property markets are also hurt, but not as badly, because while demand is leveling off, there isn’t any problem with overbuilding. Supply is reasonable. Our inventory, capital spending, collateral, and emotional accelerators are now all working in reverse. Equity markets drop like rocks, and in particular sectors related to the recent wave of capital spending. Industrial commodities follow somewhat later. The economy is now at risk of falling into a liquidity trap, and urgent attention from central banks is required. However, as most of the decline in assets concerns equities, which largely were bought cash, the debt deflation problem is not insurmountable, and central bankers’ tasks is not too hard. The next 4.5 years evolve pretty much like the first 4.5 years in our story, as the economy recovers from the crisis while companies still hold back. Tight property markets mean that rentals and selling prices now are firming up considerably, and CAP rates and ROIs are looking increasingly attractive when compared to interest rates. New land is being zoned and subdivided, selling is brisk, and building starts as consumers join the party and snap up summer houses. The property boom leads to overall growth, and several accelerators are now in effect at the same time: monetary, inventory, capital spending, and property accelerators are all working their magic. It is not until some 15–16 years after the end of our last, great crisis that the frenzy finally loses steam. Real estate is now severely overbuilt, capacity is excessive, consumers are stretched beyond their limits, inflation is rising and central bankers are raising rates to stop it all. Everything stalls, and then collapses, leading to debt deflation, banking crises, and paralysis as the central bank tries in vain to revive the economy for several years – it’s time for our credit crunch, culminating 18 years after the last time. We have passed through four inventory cycles, two capital spending cycles, and one property cycle.

Graphical Analysis

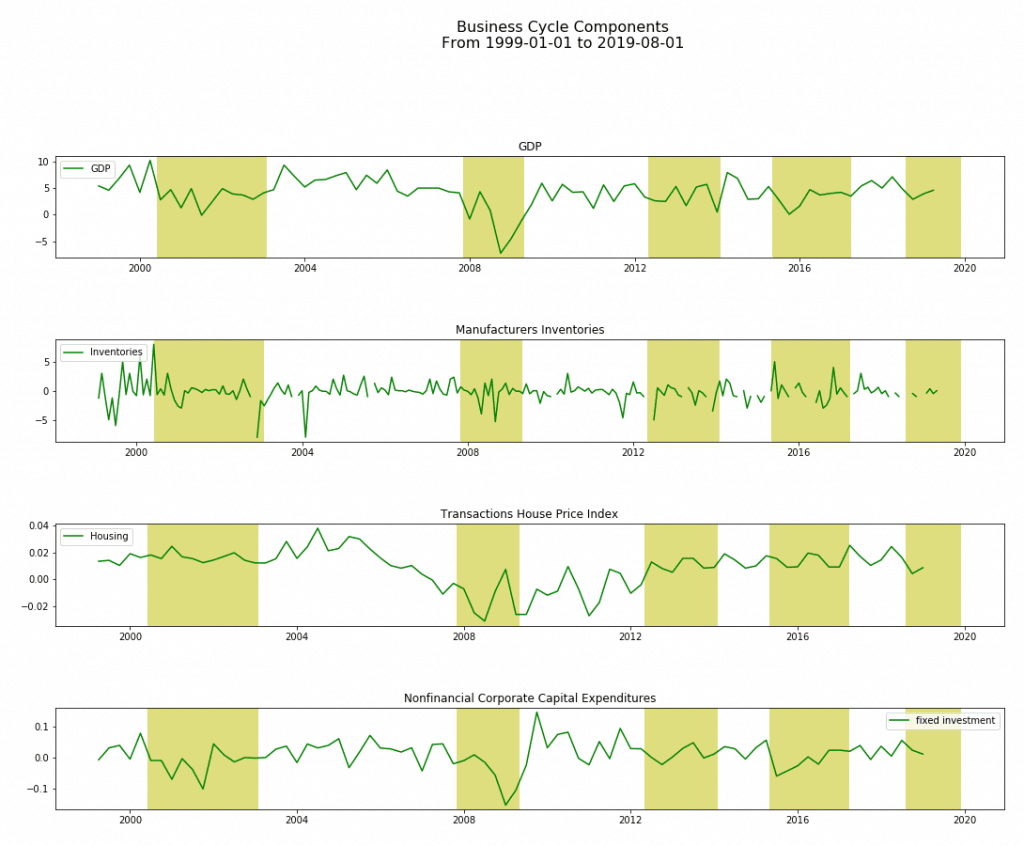

It is simple to chart with Python the variables tracking the business cycle components (inventories, housing, and credit); recessions are shadowed according to OECD based Recession Indicators (USARECM).

However, greater insights are provided by institutions as ECRI and Conference Board.

References

Lars, Tvede. Business Cycles: History, Theory and Investment Reality