Economic Indicators: Forecasting Bad Weather

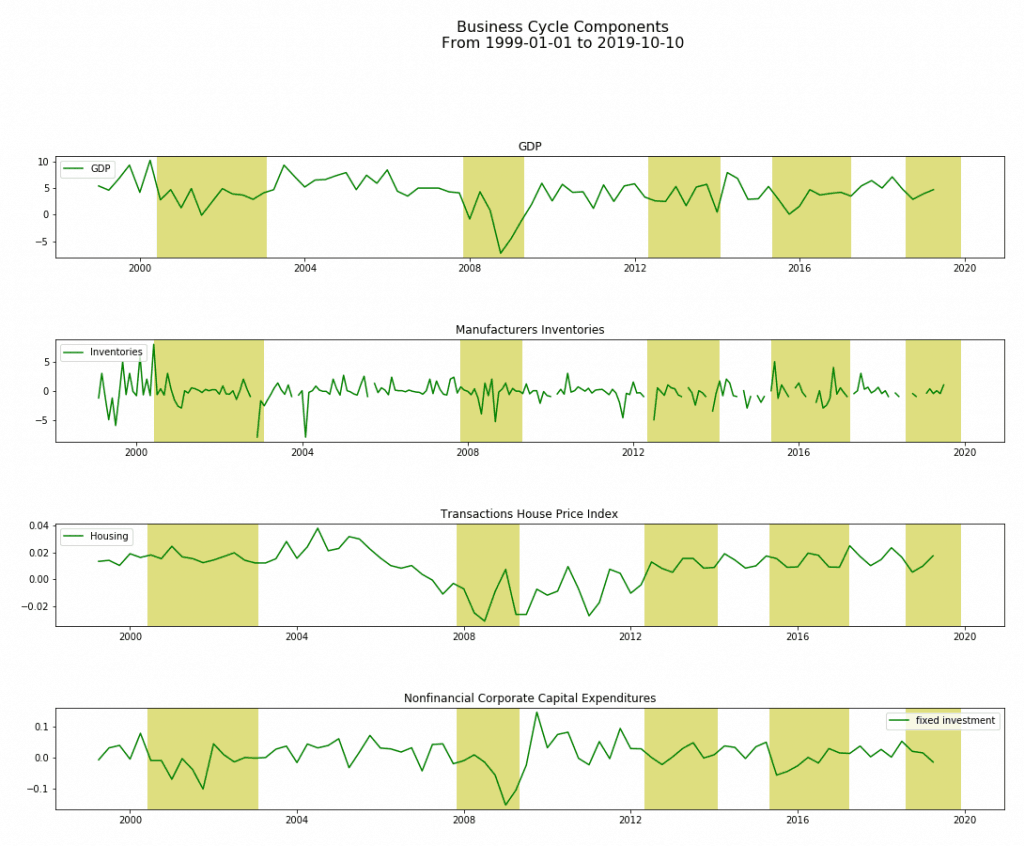

Economic indicators are changing. The US markets are moving out of a distribution phase consisiting of lateral movements and indecision in market sentiment: will it result in a mark-down and in a recession?

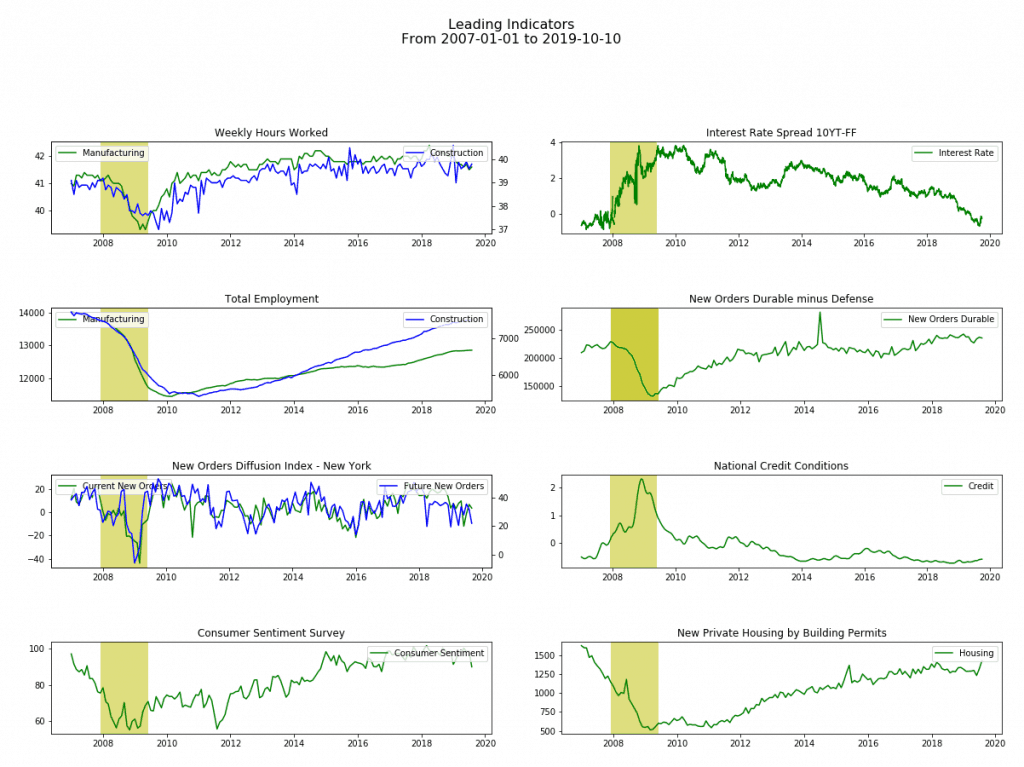

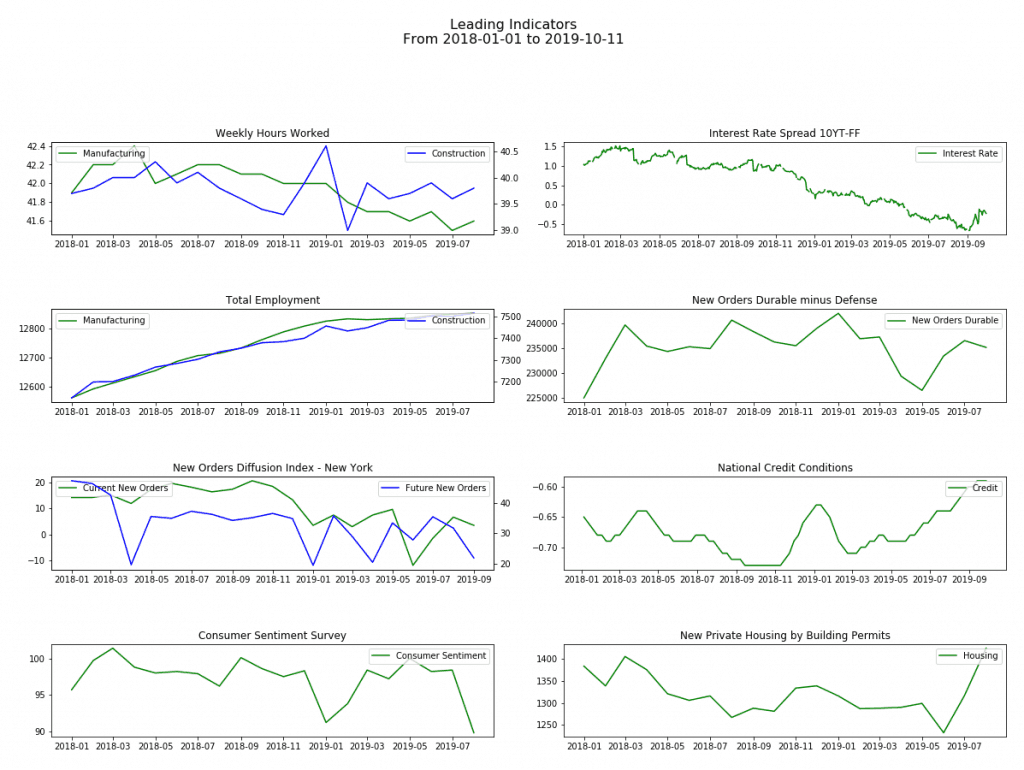

The US economy is still not heading to a recession. However, various macro signals and economic indicators imply a slowdown:

- the property market has reached its highest

- gold is running again

- unemployment is growing

- the PMI index is decreasing

- commodities are slowing due to the impact of the trade war

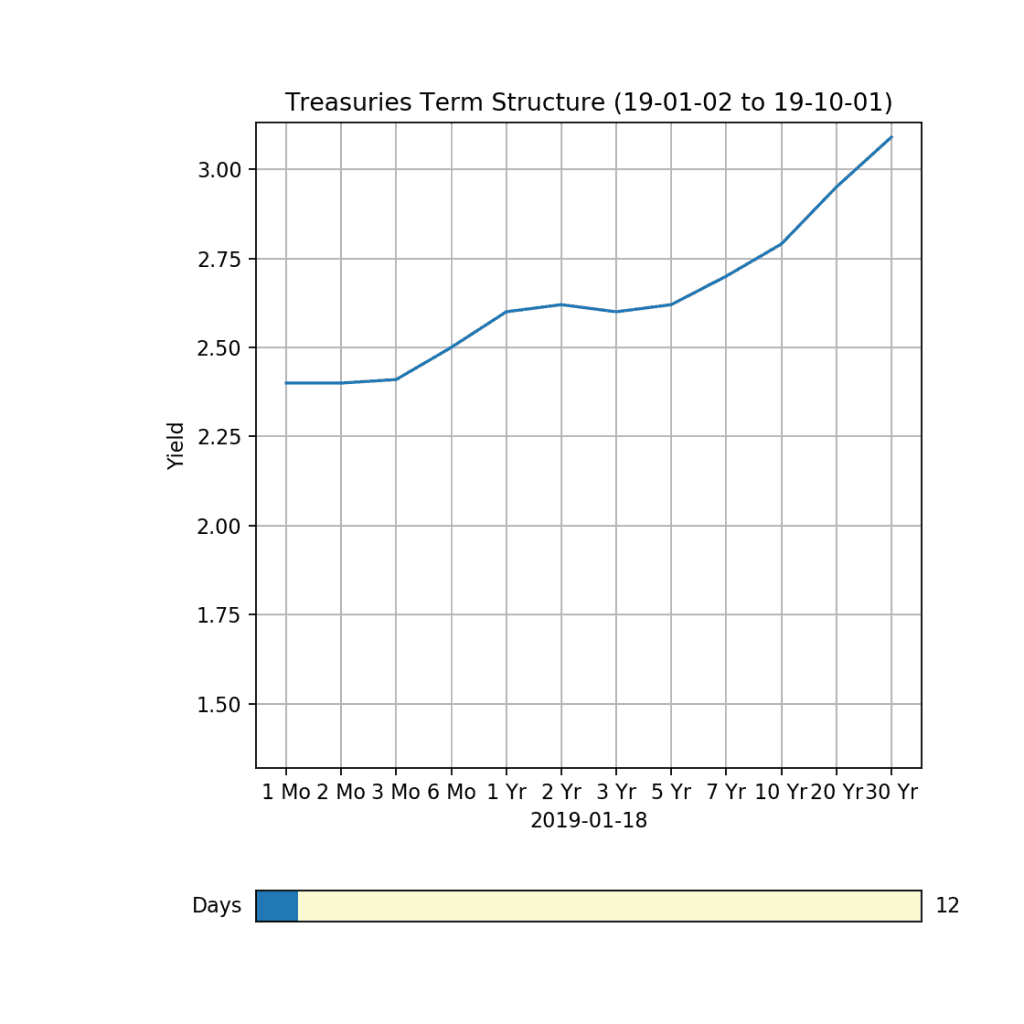

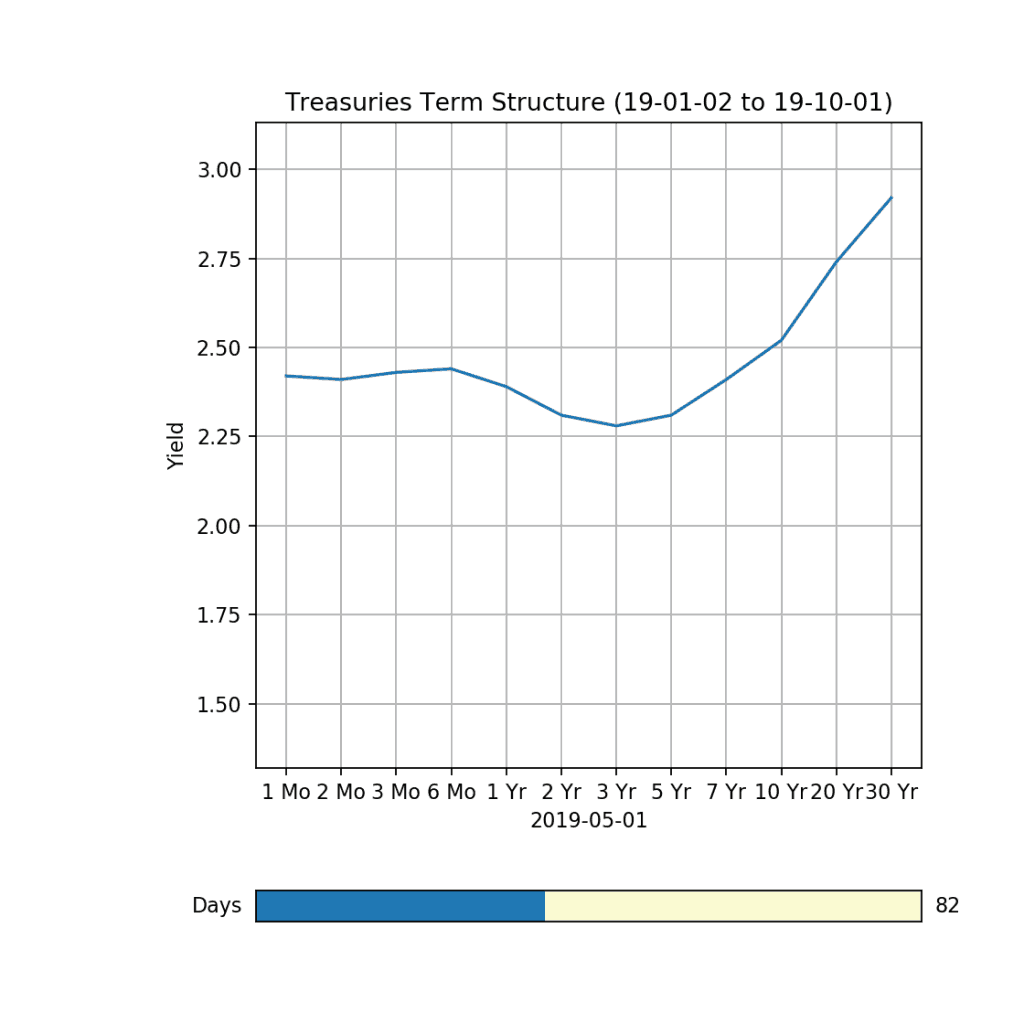

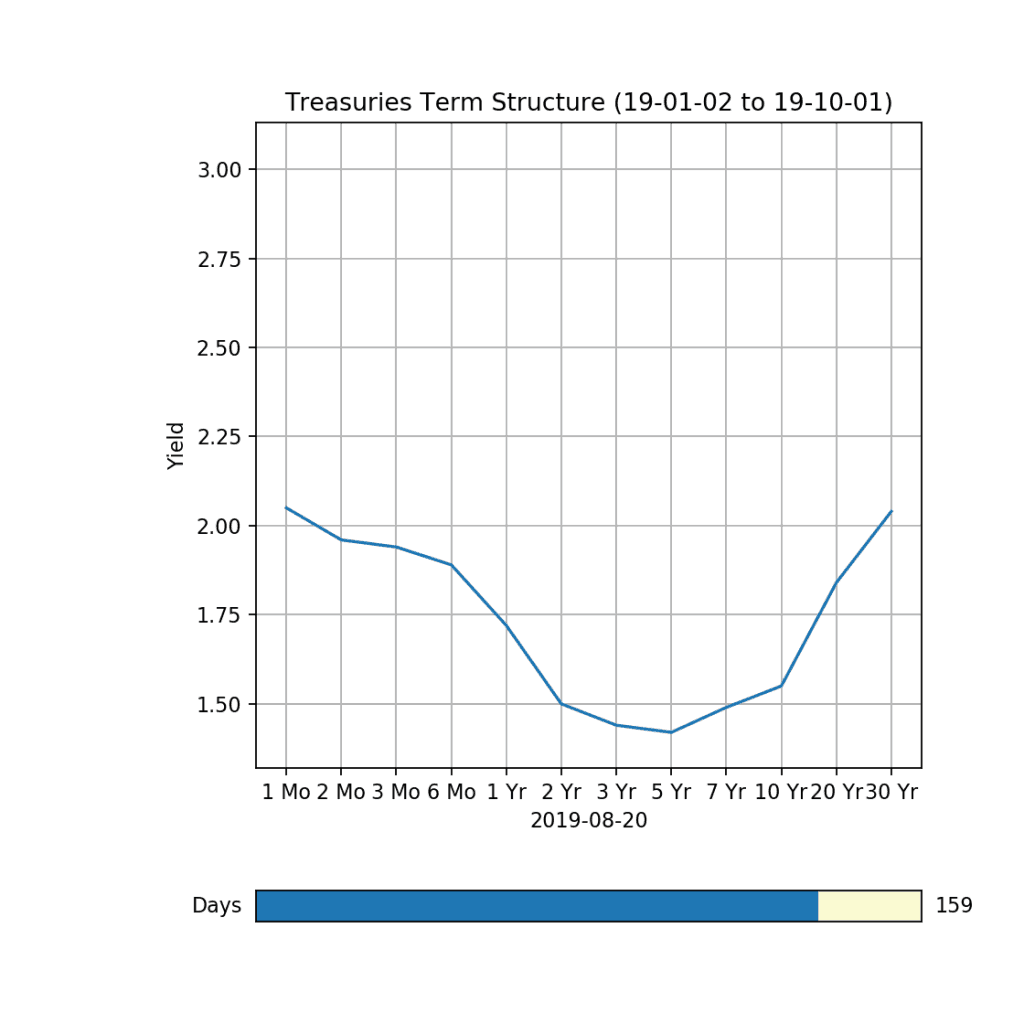

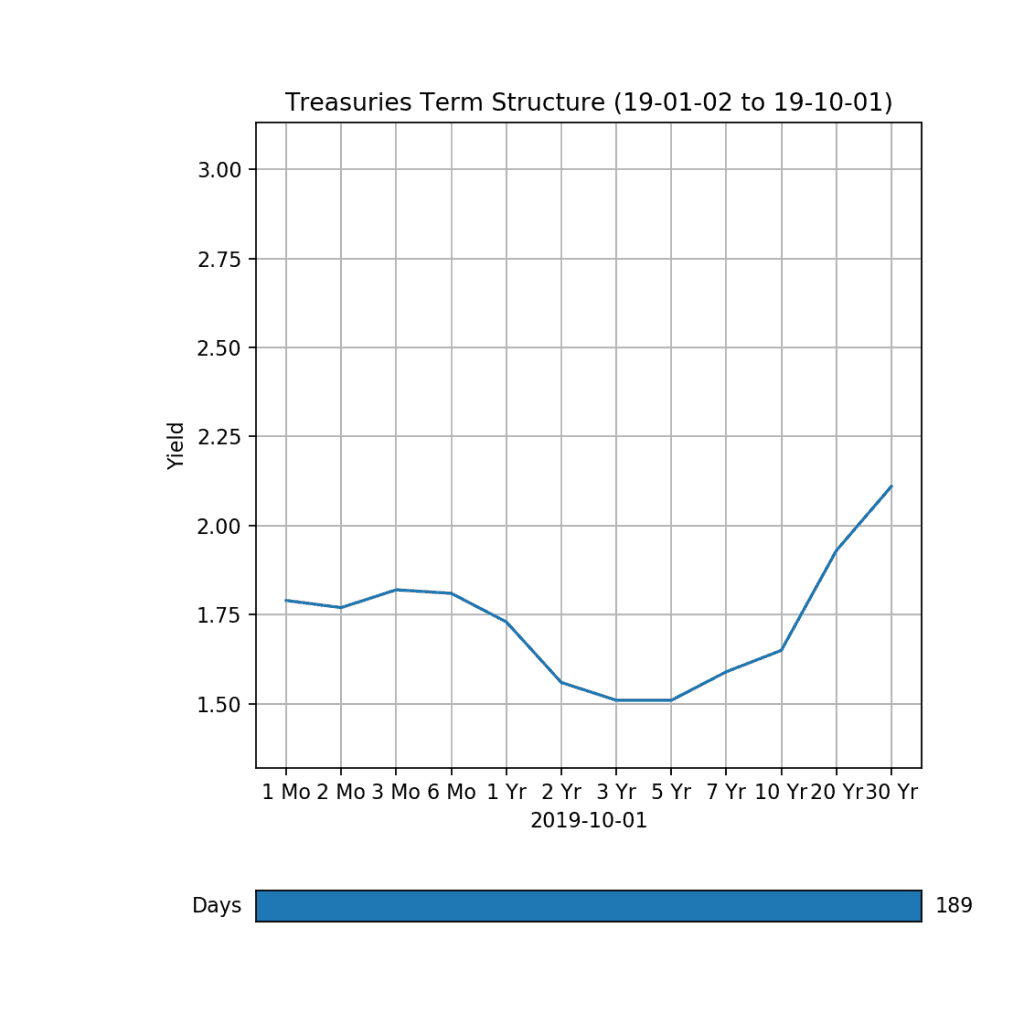

Notwithstanding, sector rotations are now a reality and the consistent pick-up of Utilities and Consumer Staples (up more than 10% from January 2019) means the financial cycle is well beyond its peak. The yield curve suggests much more than an adjustment:

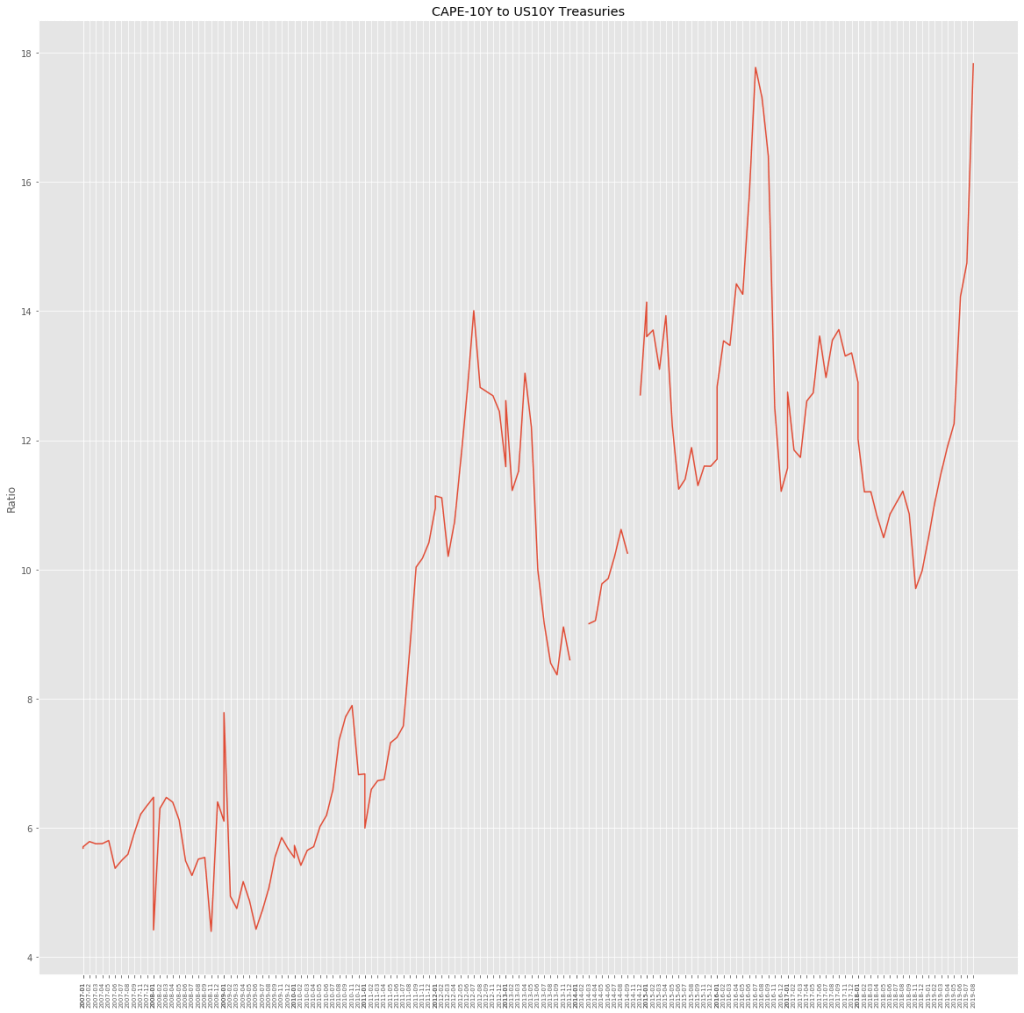

Correlations between equities and bonds have varied dramatically over the last 10 years, ranging from approximately -0.8 to 0.2. However, when looking at how stocks are cheap or expensive relative to bonds, it seems that the era of zero rates has modified the long-term level of their ratios. Accordingly, the slow-down is bringing valuations towards a new normal (but higher) level.

Thus, we may conclude that the market top has been already reached by US stocks and that a defensive move is more than appropriate if not already taken.

References

CAPE. Retrieved from http://www.econ.yale.edu/~shiller/

Treasuries Yields. Retrieved from https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2019

Monitoring the Economy. Retrieved from https://home.treasury.gov/data/monitoring-the-economy