Sentiment Analysis

In finance, sentiment refers to the measurement of the excessive confidence, either positive or negative, of investors in a specific situation. The fundamental reason why it is studied is because psychologists determined sentiment as a relevant factor affecting the judgement and decisions of investors.

However, researchers also considered whether it might affect financial asset prices in relation to momentum. Indeed, the Hong and Stein (1999)’s framework considers news as a slowly diffusing process in which listeners react in sequence and determine momentum; specifically, some momentum traders might not only reject news but overreact. As a result, researchers posited that news-based traders are biased by cognitive dissonance (i.e., information determines an overreaction in the opposite side of the existing belief). In other terms, during periods of positive sentiment investors avoid to consider bad news for losers whereas during periods of negative sentiment investors avoid to consider good news for winners.

Therefore, it is linked to various phenomena and is in itself at the roots of momentum; specifically, it is a relevant factor for post-earnings announcement drift, fund flows, corporate disclosure, IPOs, size and value effects.

However, sentiment alone is generally not useful for trading. For instance, take the code below demonstrating how it is scarcely correlated with returns:

Instead, as a trading tool, it is best employed with momentum; indeed, a simple multiplicative combination is a robust predictor of the S&P500 percentage change over the next month. Specifically, it can be successfully used during periods when sentiment has been declining and return momentum is negative, which taken together forecast a negative contribution to the stock return over the next month.

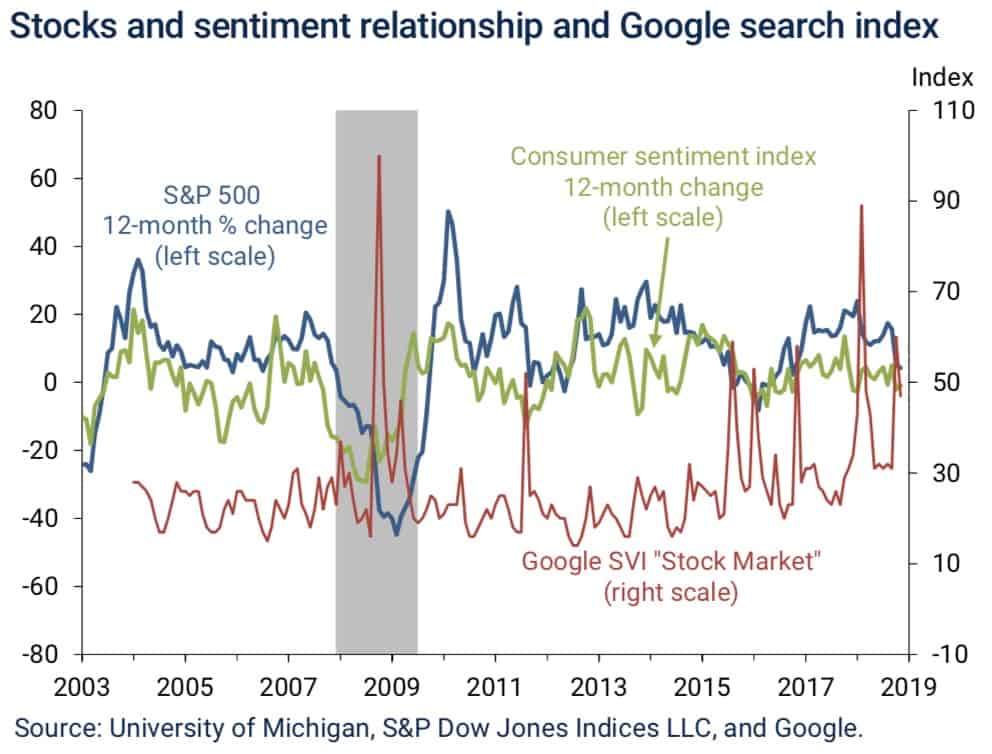

As a further confirmation, the SM predictor is correlated with two proxies of investors’ outlook for stock: Google searches for “stock market” which usually increases when prices and consumer sentiment are both decreasing.

References.

Antoniou, C., Doukas, J.A., Subrahmanyam, A. (2013). Cognitive Dissonance, Sentiment, and Momentum. The Journal of Financial and Quantitative Analysis, Vol. 48, No. 1

Lansing, K. J., Tubbs, M. (2018). Using Sentiment and Momentum to Predict Stock Returns. FRBSF Economic Letter.