Finally Sector Rotation?

Between the practice of trading and the academic empirical studies lies the sector rotation. On one hand, most evidence about business-cycle rotation suggests it doesn’t work whereas, on the other, practitioners have employed value-based sector rotation with some success. After a short review, my suggestion for the coming months…

Price Formation

The aggregation of new information in the market determines a change in relative prices during trading to accommodate the incorporation of such new information; however, such a process occurs during rebalances in what is termed orderflow (i.e., a sequence of purchases or sales based on some fundamental information). Thus, orderflow relates to asset prices but differs in its informational content. Moreover, market frictions (i.e., noise trading, iceberg algorithms, public material information, etc.) generally hinder our ability to clearly understand the quantity of information included in orderflows.

Equity Allocation across Industries

Studies have showed that most institutional investors review asset allocations by updating views about the economy, trade, and the business cycle with a three-months forecast. In other terms, large patterns of trades (active orderflows) from one sector to another do occur and are, to some extent, predictable. Traditionally, money flows into transport, technology, and capital goods during expansions and in utilities, consumer staples, and energy during contractions. Finally, macroeconomic news have specific importance in determining adjustments to investors’ views and, thus, to rotations.

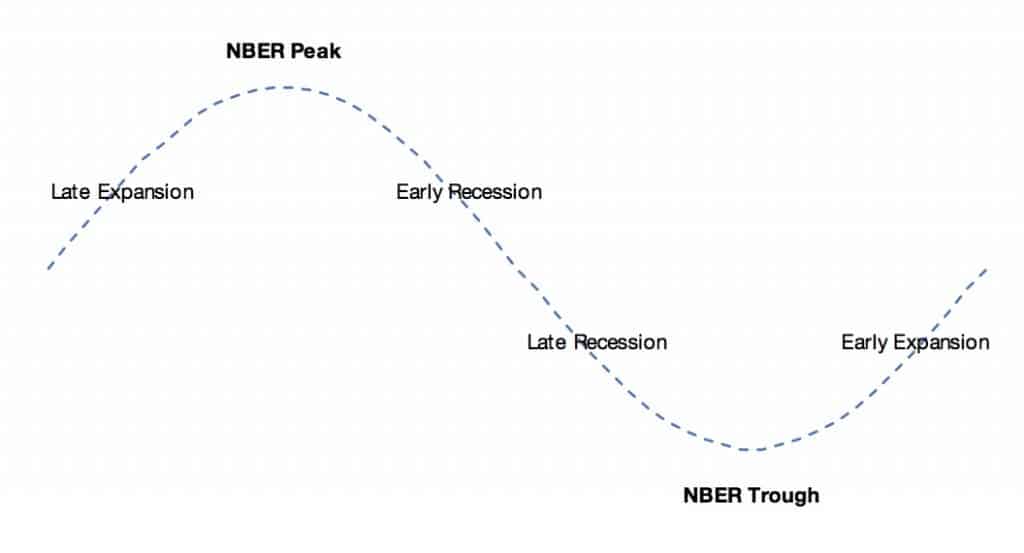

Sector Rotation Across the Cycle

Therefore, a defensive strategy can be integrated with a carefully planned sector rotation by profiting from macroeconomic news incorporation into the investors’ views about the economy.

The table below summarizes a group of ETFs that can be employed to adjust your portfolio in such respect (however, cheaper counterparts are available from SPDR):

| Sector | Sector SPDR ETF | Inverse Sector SPDR ETF (leverage) | Sector Futures (GLOBEX) |

|---|---|---|---|

| U.S. Materials Sector | XLB ETF | SMN ETF(-2x) | IXB Future |

| U.S. Energy Sector | XLE ETF | ERY ETF(-3x) | IXE Future |

| U.S. Financial Sector | XLF ETF | SKF ETF(-2x) | IXM Future |

| U.S. Industrials Sector | XLI ETF | SIJ ETF(-2x) | IXI Future |

| U.S. Technology Sector | XLK ETF | REW ETF(-2x) | IXT Future |

| U.S. Consumer Staples Sector | XLP ETF | SZK ETF(-2x) | IXR Future |

| U.S. Real Estate Sector | XLRE ETF | SRS ETF(-2x) | |

| U.S. Utilities Sector | XLU ETF | SDP ETF(-2x) | IXU Future |

| U.S. Health Care Sector | XLV ETF | RXD ETF(-2x) | IXV Future |

| U.S. Consumer Discret. Sector | XLY ETF | SCC ETF(-2x) | IXY Future |

Furthermore, liquidity and managed assets are important factors in ETFs’ selection.

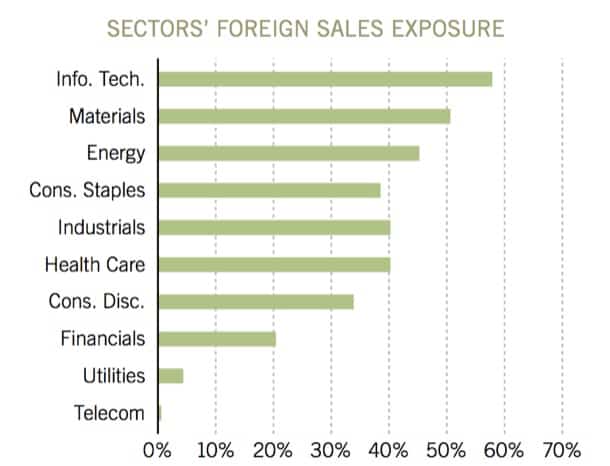

Liquidity and Interdependence

It is of paramount importance to assess the extent of liquidity in the target markets to understand whether money is flowing towards safest assets because of increasing geopolitical risks or whether market is normally liquid with operators working to improve their asset allocations. In the former case, cash is king. We look at the latter, for which we consider the extent of interdependence in sales term depending on foreign macro expectations.

Tilt your Portfolio Towards…

Assuming you are already in a defensive position, the coming but quick recession, the political turmoil in U.S., and the Iran issue suggest profits may come from reinforcing your positions in healthcare (look at the debate here) and energy (overweighting carriers for oil, gas, etc.) whereas more conservative investors should profit from emerging markets’ ETFs of mid and long-term corporate bonds. Transport looks messy for now…

References

Does Sector Rotation Works? Retrieved from https://www.etf.com/sites/default/files/conf_redesign_img/inside_etfs/IECPresentations/Tuesday250PMTRACKASECTORROTATIONCOREYHOFFSTEIN.pdf

Beber, A. Brandt, W. A., Kavajecz, K. A. (2010). What Does Equity Sector Orderflow Tell Us About the Economy?